Being a lean treasury management team can make it challenging to scale. However, building a solid foundation for your treasury to enable growth is not impossible. Today, there are many technological advances at treasurers’ fingertips.

You can establish a solid foundation for your treasury with the right technology, collaborate with others, and focus on low-hanging fruit.

How To Optimize Treasury Management Processes as a Lean Team

1. Utilize Technology To Automate Time-Consuming Tasks

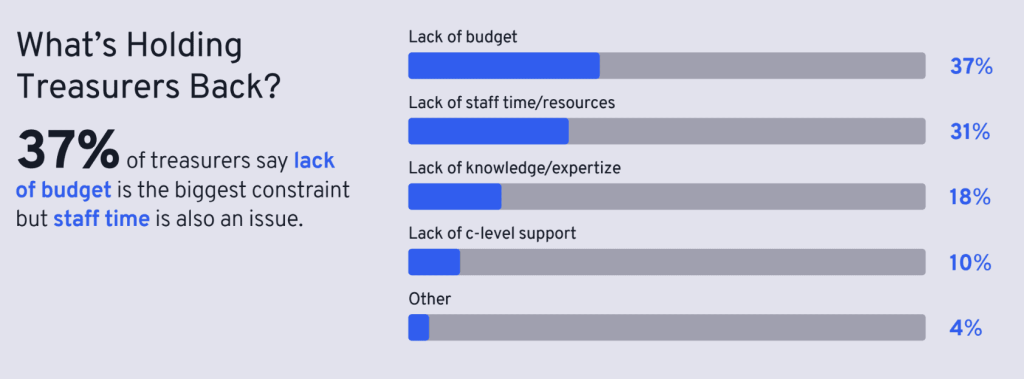

In a survey conducted by Trovata and Treasury Dragons, 37% of treasury respondents report that a lack of budget is their most significant constraint. The second was a lack of time and resources at 31%.

Thanks to open banking APIs, treasurers can automate many of their most time-consuming tasks. These APIs connect directly to bank portals across different banks, enabling third-party developers to automate data aggregation and normalization.

This level of automation is necessary, especially for lean teams. Managing cash flow in spreadsheets is no longer feasible.

Transaction volume continues to scale as your business grows, so by sticking with spreadsheets, you are opening yourself up to financial risk. Manually normalizing data is time-consuming, prone to error, and naturally silos data.

An automated cash management platform, like Trovata, does the data management for you. Trovata automates bank data aggregation and normalization across crucial accounts.

Our clients, such as Eventbrite, save over 48+ hours a month by automating tedious aggregation. These new platforms don’t just cut time-consuming processes but also help identify new growth opportunities.

2. Prioritize Opportunities With Low-Hanging Fruit

Modern cash management platforms make identifying new cash flow trends easier. You can gain rich insights that would be otherwise impossible to discover within spreadsheets.

Using a Multi-Bank Data Lake™, bank data across different banking partners is perpetually stored. This enables treasuries to analyze historical data without requesting thousands of bank statements.

Machine learning algorithms then look for patterns within your aggregated bank data. These algorithms strengthen cash reporting and forecasting by recommending usable data sets with tags. These capabilities make generating accurate reports and forecasts quicker and easier across accounts.

Establishing this baseline of automation is the best low-hanging fruit optimization opportunity you can take advantage of.

By having your aggregated bank data paired with a comprehensive suite of cash reporting and forecasting capabilities, you can better keep track of critical treasury KPIs such as:

- Cash Forecasting Accuracy

- Percentage of Payments Containing Errors

- Percentage of Payments Released On Time

- Daily Cash Balances vs. Forecast Percentage

- Non-Interest Bearing Cash vs. Total Cash Percentage

- Restricted Cash vs. Total Cash Percentage

- Days Cash Available

Having an easier way of tracking these KPIs can help you make more informed decisions and maximize liquidity.

Still, many teams face budget constrictions that limit treasurers’ opportunities to efficiently optimize their treasury management. If you find yourself in a similar situation, you must make your voice heard throughout your organization.

3. Communicate With Others Throughout Your Organization and Make Your Voice Heard

Technology will not fix all of treasury’s woes; it takes a team to scale your treasury operations. You need to be your own advocate by demonstrating that automation technology can empower better decision-making.

It’s critical to start conversations with your IT team and financial leadership to explain the impact that a platform that utilizes banking APIs and machine learning could have on your organization.

An excellent way to do this is to build a business case.

Your business case should detail:

- Processes That Can Be Automated. If any processes can be automated, do not stick with old methods just because that is what people prefer. Time saved through automating tedious processes enable your team to focus more on strategic analysis.

- New Tools and Technologies That Enhance Treasury Functionality. Technology is constantly changing and expanding, bringing new growth opportunities with it. First, it’s critical to gain a solid understanding of what treasury processes are manual. From there, research which solutions can promise to simplify tedious day-to-day tasks.

- Opportunities Where Data Mining Could Be Applied for New Insights. Automation and machine learning technology can empower you to find new patterns within your bank data that no human could. For example, machine learning algorithms are always analyzing your data to find patterns and recommend tags that make reporting and forecasting seamless.

- Questions That Cannot Currently Be Answered, But Could Be Through New Technology. Analyze what information, that you don’t have access to now, would enable you to make more accurate business decisions. If you cannot currently find the answer because of siloed data, it presents an opportunity to use new tools to discover those unanswered questions.

Having this business case in tow, you can show the value of automating tedious treasury tasks to leadership. You can make your voice heard and back up your experience with empirical evidence.

Ensure Success As A Lean Treasury Team With Trovata

You don’t have to optimize your treasury management on your own. Trovata works alongside your team to automate cash reporting, forecasting, and analysis. Learn how you can gain powerful insights by building an agile treasury management strategy.

Download our latest resource, 5 Keys To Successful Treasury Management, to discover how to build a strong foundation for growth with a lean team.