It’s only been a few decades since companies have been reliant on paper bank statements and a paper-based general ledger. It could take days, if not weeks, to gather all bank statements, manually write down all transaction information, and consolidate it into a single cash flow report. If you wanted to look at data in a different way, you were back to designing a report from scratch.

With the arrival of Excel 1.0 in the 80s, the very first graphical user interface (GUI) spreadsheet program, financial professionals could finally quickly adjust a spreadsheet and copy and paste previous data into another sheet.

While this made editing easier, bank data still had to be entered manually, which is still a prolonged process that takes time away from performing strategic analysis.

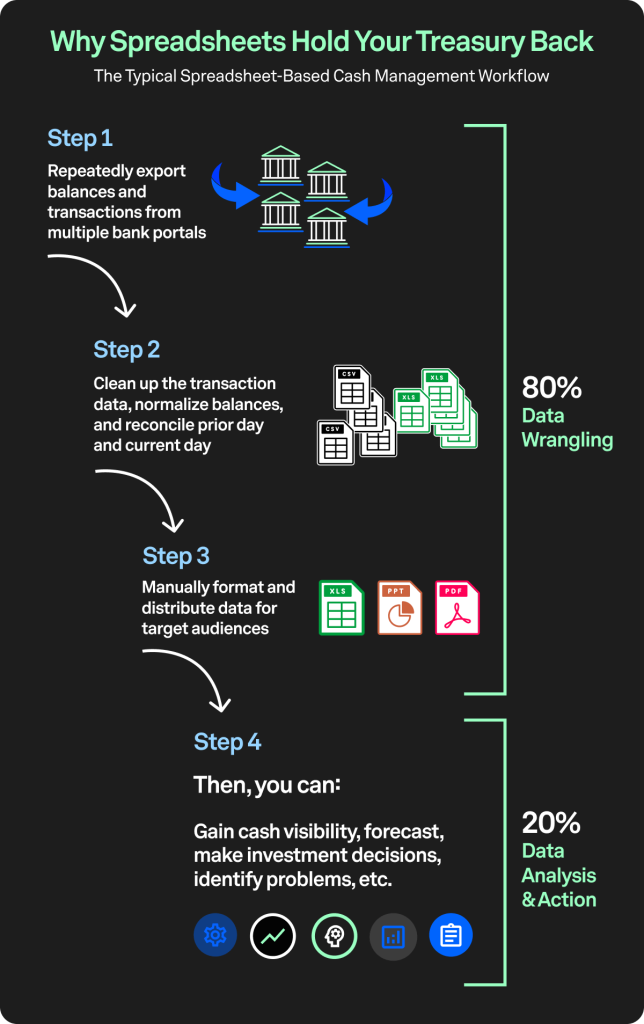

This is where many companies still find themselves to this day: being held back from achieving real-time cash visibility into their cash flow by spreadsheets. As you can see in the workflow below, several preparatory steps are needed, from downloading bank data to reconciling file formats, just to tee up your data to make use of it.

4 Ways Spreadsheets Are Holding Your Treasury Back

- Consolidating bank data manually is incredibly time-consuming

- Manual entry invites the potential for human error

- Siloed spreadsheets and data sources limit transparency and visibility

- Spreadsheets lack sophistication when performing daily cash analysis

Consolidating Bank Data Manually Is Incredibly Time-Consuming

Manually consolidating bank data into a single spreadsheet is time-intensive, reducing the hours you have to analyze your cash forecast and trends. Many of our clients, like GoTo, have saved 7+ hours a week by eliminating manual data entry with automation.

“With Trovata, I am able to go in and make changes to our cash management processes on-the-fly. With other options in the market, I would have to submit a request that would take a number of days, sometimes weeks, for them to even get something into production… I can go into the platform and basically self-serve myself to what I need, which is something special in the treasury space.”

– Tim DiLillo, Sr. Director of Treasury and Investor Relations at GoTo

Manual Data Entry Invites the Potential for Human Error

We’ve all been there when our cash position in spreadsheets doesn’t reconcile with what is in the bank.

Fixing this often involves scouring bank statements and finding that one transaction you may have missed in your books.

While you may say that you’ll be careful the next time, there’s still that potential for human error, which could affect your organization’s decision-making and reduce the time for analysis.

Siloed Spreadsheets Limit Transaction and Cash Visibility

Spreadsheets were never designed to be mass-edited in the cloud as they are not a centralized tool. Version control can become a significant issue if multiple people are working on a spreadsheet at once; It becomes hard to determine who has the most up-to-date data.

While the flexibility of spreadsheets can be a blessing, it can also be a curse in your pursuit of a secured database that can analyze big financial datasets. Siloed spreadsheets limit visibility, effectively ensuring your team is potentially making decisions with blinders on.

Spreadsheets Lack Sophistication When Performing Daily Cash Analysis

As your business continues to scale, you’ll find that your balance and transaction history increases exponentially. Spreadsheets simply cannot process and analyze large financial datasets as it becomes improbable to not only maintain your historical data, but your spreadsheet may not even be able to process data requests and macros due to being processed on one computer.

By adopting a more centralized, in-the-cloud database solution, you can open your business to discover new opportunities in your data that you simply couldn’t before.

Two Truths of Cash Management

To gain richer insights into your balance and transaction data across your global bank accounts, you need real-time cash visibility. You can achieve that level of visibility by automating the integration of all your data into one single platform. Simply put:

- Automation is a must for cash flow management and forecasting

- Modern tools can present new opportunities

Automation Is Necessary for Cash Flow Management and Forecasting

Automation is an absolute necessity as your business grows. Accurate decisions can only be ensured if you have an accurate, real-time view of your bank data across all your critical accounts and ERP systems. This is especially important during recessions, as seen during the COVID-19 pandemic.

Organizations that did not have a real-time view of their cash flow ran the risk of not being able to adapt their cash management strategy quickly enough before revenue dried up.

Fortunately, bank APIs are revolutionizing how treasurers and finance teams are getting data. Trovata’s extensive library of APIs compatible with banks, such as Bank of America, J.P. Morgan, and more, connect directly to your global banking portals and automate the aggregation of your bank data into a Multi-Bank Data Lake™.

These APIs also connect to your ERP of choice, like Sage and NetSuite platforms, empowering you to automatically pull open invoices, unpaid CC transactions, unapplied payments, and unpaid bills data from your ERP into your Trovata Analytics Platform. This makes it easier than ever to track and manage cash flow and payments in one, secure platform.

This level of automation opens the opportunity for many new modern tools that analyze your data and help provide your organization with richer insights into your business’s cash flow.

Modern Technology Presents New Opportunities

Pairing your historical bank data with new technologies, such as artificial intelligence (AI) and machine learning (ML), can present new insights no human could ever imagine discovering.

Trovata’s machine learning algorithms analyze all your bank data and distribute it amongst Trovata’s analytic and forecasting tools, enabling you to generate cash reports and forecasts automatically. Artificial intelligence then takes your historical data and makes predictions based on your historical data, increasing your cash flow forecast’s accuracy.

These new technologies can enable you to:

- Automate your forecast baseline

- Generate multiple scenarios with flexible user-defined variables

- Easily perform variance analysis to increase forecast accuracy

- Segment transactions into relevant tags automatically based on patterns within your data

- Perform Google-like search and be provided a list of transactions across key vendors, institutions, clients, and transaction-types within milliseconds

- Initiate and send payments across supported bank partners in one, secure platform without unnecessary transaction fees from third-parties

- And much more!

The cost and time savings plus access to richer insights empower you to focus on strategic analysis and objectives that propel your business forward to the next level.

Graduate From Spreadsheets to Automated Cash Management

By sticking with spreadsheets, you are relying on siloed data sources prone to human error and time-consuming reconciliation, limiting your ability to make critical, data-backed decisions.

With Trovata, our next-gen, automated cash management platform, you can gain unified access to the richest banking data across all your key accounts.

Download our Essential Treasury Reporting and Forecasting Guide to learn how to achieve efficiency throughout your treasury operations with best-in-class reports and automated cash management technology.