Corporate budgets are under a microscope in today’s business climate. Understanding your cashflows is critical to mitigating risk, extending your financial runway, and unlocking growth opportunities.

Here at Trovata, we are constantly searching for the best ways to help our clients gain even greater visibility into their cash so they can make the best decisions around cash management.

In this article, I will share everything new in Trovata so you can fully take advantage of our cash flow management platform.

What’s New in Trovata?

Morgan Money

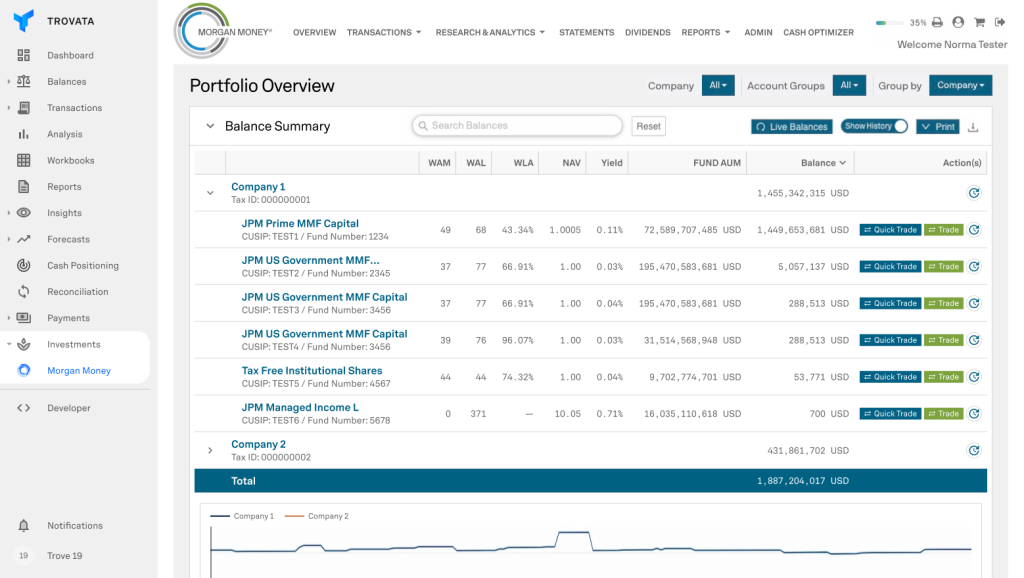

In December, we announced that we’ve partnered with J.P. Morgan Asset Management, a global leader in investment management to enable our joint customers to use Morgan Money’s services to access higher yields on corporate investing.

Available now, Trovata users can tap into Morgan Money’s services directly from within our cash flow analytics platform for seamless access to Morgan Money’s trading, analytics, and reporting.

How It Works

Powered by a Single Sign On, you can seamlessly navigate between cash insights from Trovata and Morgan Money. In addition, Trovata is integrated with Morgan Money APIs for balance and transaction data, allowing you to see your Morgan Money data alongside your bank data for use in all Trovata features.

Benefits of Our Morgan Money Integration

- Manage and monitor operating and investing activities all from within the Trovata platform.

- Determine your liquidity needs using Trovata, then take action to invest seamlessly using the services offered by Morgan Money.

- Morgan Money allows its customers to transact across their portfolios in real-time and compare funds across multiple managers, currencies, durations, or settlement options.

Note – Trovata is not a financial services firm, nor do we offer any investment advice or recommendations. Visit the official Morgan Money website to learn more.

Cash Positioning

Take a proactive approach to daily cash management with Trovata’s newest feature: Cash Positioning. Now it’s easier than ever to identify projected excess cash and call attention to balances that fall below a preferred target.

Cash Positioning helps to manage cash more effectively through things like overnight investing and loan repayments while decreasing the risk of overdrawing an account.

How It Works

Trovata continuously receives and normalizes your data so you don’t have to. See your cash position change in real-time as it accumulates intraday transactions throughout the day.

Check out this quick tour of Trovata’s cash positioning module:

Cash Positioning Benefits

- Obtain a consolidated & account-level view into current cash position, projected daily excess cash, and daily target balance .

- Analyze your cash position from various perspectives on the fly. Create and save views by bank, entity, region, division and currency.

- Calls attention to “at risk” account balances (# of accounts below target).

- Flexibility to create and reconcile assumptions throughout the day.

How to Get Started with Cash Positioning in Trovata

If you have a Trovata corporate subscription plan or higher, you will be able to access this feature from the main navigation menu. If you are not on this plan, you can choose to start a free 14-day trial.

To create your first cash position, click “new position” in the upper right-hand corner of the cash position page. Then, pick which accounts you want it to include and hit done.

Next, you can change the position’s name in the settings as well as the global currency conversion, balance rounding, and weekend preferences.

Now, you can view your cash position as needed and adjust each account’s assumptions and target balances.

Bulk Payments

Have you noticed how increasingly fragmented and fee-laden the corporate payments ecosystem has become? Third-party payment vendors don’t leverage cutting-edge tech. They aren’t keen on changing the status quo, either. So, we set out to do something about that.

Taking advantage of our modern tech stack, we are reimagining the payments experience, building from the ground up directly on bank APIs, and passing the benefits and savings to our customers.

Trovata is the only open banking API-based payment experience that replaces bank portals, safely manages approvals, and offers real-time payment capabilities. With zero added fees.

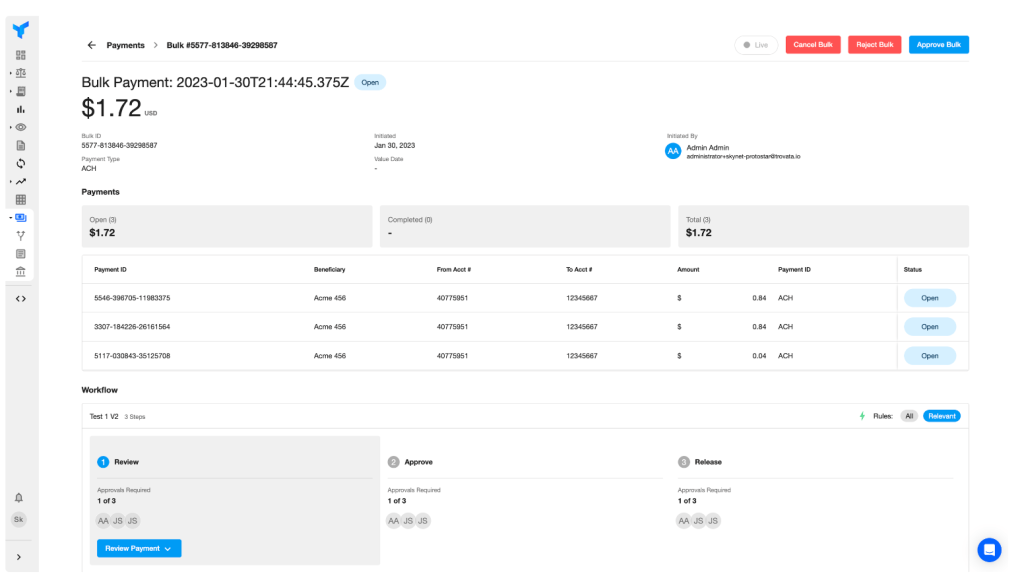

And now, exclusive to Trovata, you can send payments in bulk, eliminating the headaches of batch payments.

How Bulk Payments Work

If you’re familiar with batch payments, you know that if you send a batch payment, your bank will charge you for the file plus a small amount for each payment.

Unfortunately, if just one of the payments contained within that batch is declined, it’s possible that the entire batch will be too! If the entire payment batch fails, you’ll have to take the time to go through your reporting to reconcile it.

We created bulk payments as an answer to both of these problems. With bulk payments, you can make mass payments in your Trovata portal without incurring any third party processing fees! Due to our API integrations, each payment within the bulk is still submitted individually to your bank.

So if one payment gets declined, you’ll easily see which one it was, making what would normally be a tedious reconciliation process no longer a hassle. Best of all, bulk payments appear as one line item in reporting like batch payments.

Advantages of Bulk Payments

- Submit payments in bulk with an export from your ERP

- Manage payments in bulk through Trovata and approve them

- Payments are still submitted individually via the bank’s API

- Payments will be on the transaction record individually

- Failures or returns of payments can be managed individually

- Without the need to unbatch, transaction reconciliation becomes easier

How to Get Started With Bulk Payments in Trovata

To get started, you’ll need to establish a workflow for bulk payments by clicking the “New workflow button” in the upper right hand corner of the Workflows module. Once a bulk workflow is set up, initiating a bulk payment is pretty straightforward.

First, select the “Import Payments” button under New Payment. A screen will open where you can upload your bulk payment CSV file. If you’re unsure what data your bank requires, hit the “View Format Requirements” button on this pop-up screen.

Then, upload your CSV file, confirm all details for the imported payments, and submit the payments. The workflow for bulk payments (located at the top of the workflow screen) will then be triggered to review/approve/release these payments.

To view all your bulk payments and the status of the bulk(s) as well as the individual payments in the bulk(s), go to the Payment dashboard (on the Payments tab), and you can view all your bulk payments by selecting the bulk payments tab.

Workbooks Updates

Although we are proponents of automating bank data aggregation and analysis, sometimes, you will have a rare case in which you need to finesse your cash data in a spreadsheet. We get it.

That’s why Trovata’s paid plans include our Workbooks feature, where you can design a spreadsheet containing a customized view of your Trovata data that refreshes whenever you need it to.

Recently, we enhanced the Workbooks feature with these updates:

- Data outlets now support balances and transactions

- Multiple data outlets per sheet

- Customizable data ranges

How It Works

The Workbooks page will display a blank sheet at first. You will want to add a data outlet to the sheet, either transactions or balances. Then, you can choose a date range, select search parameters, load data, and edit your columns as needed.

And voila… you’ve got a functional and fully customizable workbook using your Trovata data.

How to Get Started With Workbooks in Trovata

If you are on Trovata’s “Start Up” plan or higher, click “Workbooks” in the navigation menu. If you’re on the free plan, you can always start a free trial of any paid plan to try this feature out for yourself!

Put Trovata’s Suite of Cash Management Tools to Work for You

We’re so thrilled to share these new feature updates with you. With our Morgan Money integration, you can now tap into Morgan Money’s services directly from within Trovata.

Cash Positioning is a powerful daily liquidity tool that allows anyone who is actively managing their company’s cash to forecast daily ending balances and our Payments feature enables you to move money to make it so.

Last but not least, we’ve made our Workbooks feature more flexible and customizable to suit your needs.

Are you an existing Trovata user? Make sure to login to try out these new features today!

Haven’t started? Schedule a demo to learn more.