In 2026, the role of the treasurer is changing. New technologies like generative AI and open banking APIs unlock data-rich insights, transforming treasury departments from cost centers into active participants in company policy.

But many organizations are stuck in the old ways, using a legacy TMS that ignores these technologies. Worse, they may rely entirely on spreadsheets, making it impossible to achieve real-time cash visibility.

If you’re here, you probably recognize all this. You know your department could save huge amounts of time and stress by adopting modern software, and you know the company as a whole would benefit.

The only thing you don’t know is how to convince your boss this is the case.

Well, have no fear. Below, we will look at the data and how to present it. First, let’s look at why new software is so critical.

The Need for Treasury Management Software

When you think of treasury software, what comes to mind? You might think of spreadsheets and legacy Treasury Management Systems (TMS).

Here are some reasons why these tools just don’t hold up in 2023:

Spreadsheets

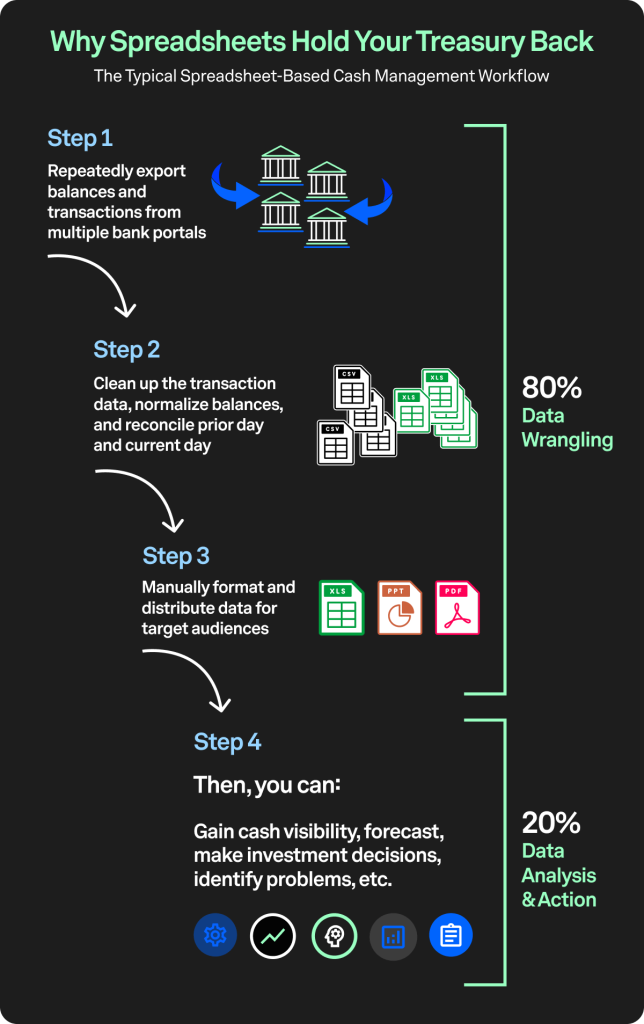

You probably know this, but spreadsheets can be a hassle, and often hold your treasury back

When data is entered manually, there’s a high risk of transcription error. Gathering data from across separate bank portals takes time, meaning that – once it’s all recorded – the data is out of date.

So, even if you avoid the first problem, and the data is totally error-free, doing things the old way will never allow you to achieve a real-time view of your cash flow/position.

Legacy TMS

Treasury management systems help you get around spreadsheets, and that’s a huge advantage. But since many of the most well-known providers are 20-30 years old at this point, they’re no longer on the cutting-edge of tech. The ones that profess to be “cloud-based” are stretching the truth. Due to aging infrastructure, they will struggle to release features that leverage new tools such as AI quickly.

To sum up, you want treasury management software that:

- Gets rid of spreadsheets

- Includes new developments like open banking APIs, automation, and AI

- Provides access to payment technologies like RTP and stablecoin

- Is easy to implement and get connected to your bank accounts

Finding the Right Treasury Software

If not spreadsheets or a legacy TMS, what else should you look for? Try looking at a modern cash management platform with full treasury capabilities like Trovata.

Whichever tools you look into, make sure they integrate with the ERP you use, like Sage or NetSuite.

You’ll also want software with excellent reviews and a proven track record – case studies that back up the developer’s claims.

While evaluating software, write out the cost and benefits of each. Which gives you the most bang for your buck – i.e., which gives you the most benefit per dollar spent?

Once you’ve concluded which software is best for your company, record the reasons why you chose that option over others.

Why?

I hate to be the one to break it to you, but right now you’re the only one excited about the new software you found. It may solve every pain point in your daily routine – but your boss just doesn’t have the bandwidth to even consider implementing another piece of software. So, how can you win them over?

Time to make your pitch… Don’t worry, here’s how.

How to Prepare Your Presentation

Identify Your Specific Pain Points

First, begin by writing out your department’s pain points in regards to your current software (or lack thereof).

Try to isolate specific experiences. Perhaps, more than once, your department took too long to determine the company’s cash position – as a result, you couldn’t respond fast enough to a crisis. Maybe you spent x amount of time last month reconciling transcription errors, some of which made it into your latest forecast.

Remember that time the company missed an investment opportunity because a cash flow forecast was inaccurate?

Bonus tip: If one of these issues ruined your boss’s weekend or made them look a bit silly in front of their boss, go right for the jugular on that one!

Detail how each of these events could have been avoided with the software you’re pitching.

For instance: cash positioning took too long? With the new software, you’d have real-time cash visibility through APIs. With automation, there’d be zero transcription errors, and cash flow forecasts would always be as accurate as possible.

Maybe you’re experiencing an ongoing issue – the business is growing rapidly and you’re having trouble scaling.

This was CrowdStrike’s problem. Over a short period, their revenue exploded from around $80 million to more than $2 billion. Suddenly, the treasury team required 40 hours each month to manually aggregate transaction data.

They were still using spreadsheets and understood this was unsustainable; they needed a better solution. So, CrowdStrike turned to API-based software to provide a real-time view of their large volume across bank accounts, much more quickly. Using Trovata, the treasury team saves tens of hours each month and can create daily cash reports within minutes.

Quantify Benefits: Time Savings, Cost Reduction, and Risk Mitigation

Identifying pain points is just the preamble. Getting down to the numbers is what will really get your boss’s attention.

Let’s start with time savings.

Determine how long it takes each week or month to manually consolidate data and generate cash flow forecasts. Do a rough calculation of how much time you’d save per week, per month, per year, by not having to do that.

Explain how, by saving so much time thanks to automated software, people in your department can do something much more productive – data analysis.

As mentioned, mass data analysis is changing the role of treasury departments, allowing them to be much more proactive and even direct the company’s trajectory based on deep insights.

Rather than hiring extra people to perform data analysis, the company saves those hypothetical costs by getting the software (not to mention, not even the most savvy hires could provide the insights that AI and machine learning can).

James Krikorian, VP & Treasurer of Krispy Kreme, had this to say about Trovata:

“Because of the free structure, Trovata is so affordable for us. From an ROI perspective, it’s free. It’s zero cost.”

More directly, the company will save costs by utilizing bulk payments over batch payments and RTP over wire transfers. Bulk payments allow you to deliver recurring payments (like payroll) without ACH fees, while RTP allows funds to be delivered instantly, permitting financial maneuverability and clearer data insights.

Since payments are instant and can’t be revoked, RTP also helps reduce risk. If there’s one thing the last few years have shown us, it’s that we can’t underestimate risk.

This is why scenario planning – a method of planning for possible future events – is a critical practice.

Usually an incredibly complicated process, the right software makes scenario planning much more practical. User-defined variables, for example, allow you to much more easily determine how an event – a specific supply chain disruption, say – would affect your business. From there, you would devise contingency plans for each scenario.]

You can make this very granular as well. If scenario planning means you would save, for example, two days in responding to a known potential issue in your projections, what does that look like from a cost saving perspective?

Paired with real-time cash visibility, scenario planning allows you to react to crises on a dime – a flexibility that will help you thrive in uncertain times and stay miles ahead of the competition.

Recommended: The ROI of a TMS: Building a Data-Driven Business Case

Craft a Persuasive Presentation

So you have your software, how it will address specific pain points, and how it will drive high ROI. Now you have to consolidate all this information into a compelling presentation.

Remember that you’re telling a story: a story of what the problems are, and the story of the department/company after adopting this software. So, begin with where things are right now. Slide by slide, you chart out the transformation the software will bring.

You don’t only have to use PowerPoint – that’s a bit boring after all! Use tools like Canva or easel.ly to create infographics that supplement your presentation.

The presentation should last no more than 30 minutes, so prioritize your points accordingly. It’s best to start with ROI, and how the company as a whole (and your manager/boss specifically) would benefit. Then move on to departmental pain points.

Tips for Successfully Winning Your Boss Over

Here are some other considerations to keep in mind when you ask your boss to consider your new treasury software solution:

- Keep it simple: Rather than going in depth about each feature or module, stick to the high-level benefits that your boss will care about most (time savings, increased accuracy, etc). Benefits that will affect the broader team and even other departments

- Let the numbers talk: chances are, your boss is a numbers person – so give them what they want

- Create a feeling: Numbers alone may not be enough. When you are able to tap into people’s deeper emotions, they are more likely to respond positively. Try telling a story around the challenge you are trying to solve. Use descriptive imagery to help paint a picture.

- Enlist support: The company whose software you want to buy, well, they want you to buy it! Don’t be afraid to ask the Sales team for help. After all, that is their job. Utilize slide decks, one-pagers, and other material sent to you from the software company’s sales team. Invite the sales team to a meeting with your boss where they can clearly highlight how the software helps your company and whether or not it’s worth the price tag.

Request a Meeting: Choosing the Right Time and Approach

Once your presentation is ready, the next step is to secure a meeting with your boss.

This is probably obvious, but catching your boss as they’re walking out the door on a Friday at 4:30 pm isn’t the best way to get this done!

When booking a time with your manager, mention one or two pain points the treasury department is experiencing and how you think the software would solve them.

Tell them that you have prepared a much more thorough presentation, and would like no more than 30 minutes’ of your boss’s time. You might even attach an ROI projection – the idea is to get your boss interested, but not necessarily drop your whole thesis.

Host the Meeting With Poise and Professionalism

We’re finally here. You’ve collected data and made it to the actual presentation.

Begin by talking about how, with its current system, the company is losing time and money. You want to make it about the company, not your specific department – at least not yet.

Explain the ROI of the software, how it will address these losses in money and time. Provide actual numbers.

Now you can go through the treasury department’s specific pain points, but always be sure to explain how solving these pain points helps the company as a whole.

If you can show your boss the tool in action, all the better. Look for software that provides free demos.

Show them how the current process works – how you have to open each bank portal and isolate the specific data you’re looking for. Then you have to format it, and only after all this data-wrangling can you actually create cash flow forecasts.

Then, show them how much easier it is with the new software. Problem, solution. You can go through each pain point like this.

Tie these points directly to the success of the organization and its ability to reach strategic goals. For instance, by having a solid cash flow forecast, refined by AI, the company can make the most optimal investments.

Follow Up: Ensure a Positive Outcome and Next Steps

Obviously, you’ll want to give your boss time to digest all the information you presented – don’t expect an answer immediately!

Regardless of how entertaining your presentation is, your boss might not absorb everything.

That’s why you should also provide a document with the most important information. Write out some of the ROI calculations you did. Write out departmental pain points, and how the software solves them.

Going above and beyond like this will show your boss that you really believe adopting the software is worth it. Even if you’re unable to convince them this time, they’ll appreciate the effort you put in.

If it goes a week or two without an answer, feel free to follow up with a respectful email.

The Bottom Line

Finding software that makes your job easier and improves the department’s efficiency is often a career enhancer. By advocating for using the latest and greatest technologies, you can help increase the effectiveness and strategic capabilities of your treasury.

This is exactly the case for Eventbrite, who upgraded to Trovata’s cash management platform, effectively being able to:

- Save 48+ hours monthly by automating bank data aggregation with banking APIs

- Reduce costs 50% by switching from a legacy TMS to Trovata

- Obtain 100% data accuracy through eliminating human error with automation

So, don’t be afraid to speak up for what you believe will benefit your company – when you do, you just might be surprised by the positive reactions. It’s quite possible that your boss hasn’t had time to stay up-to-date on what’s new in the treasury tech space, so you’re helping them to navigate new innovations.

Want to see Trovata, the next-gen, automated cash management platform in action? Book a demo today.