When it comes to day to day financial complexity, there are few industries that hold a candle to a modern retailer. Gone are the days of simple brick and mortar locations and cash. Now, you need to be able to consolidate transactions across multiple different points of sale and a dizzying number of payment providers, creating the need to simplify retail treasury.

Throw in the mix of geographical layers such as operations in different regions, or even countries (and therefore multiple currencies), and getting accurate, up to date data can be an impossible task.

Tracking all of this and keeping accurate records is obviously incredibly important, but this also highlights a key issue in growing a modern business. Data has become one of the most valuable resources a company has, but gathering the data is just the first part of the puzzle. If you don’t have the capability to be able to organize and analyze it, it has no value at all.

Luckily, digital transformation is helping to simplify retail treasury, empowering you to do both those things. Not only can tech solutions now allow real time access to financial information that is 100% accurate, but it can also enable complex forecasting, scenario planning and analysis of that data. That’s why it’s not surprising to see that 59% of executives plan to invest in tech over the next 12 months.

In an industry where margins are pushed to their limit, this provides the opportunity for an edge against the competition, and helps the finance executive to become a key strategic component of the leadership team.

The Unique Finance Challenges in the Retail Sector

You do this for a living, so we don’t need to tell you the challenges you face on a day to day basis. But before we can address how some of these problems might be solved, it’s important to lay some of them out so we’re on the same page.

Transaction Volume

Large retailers, such as companies like Krispy Kreme which we’ll discuss more later, have millions of transactions through their accounts every year. That is incredibly challenging to keep track of, and even harder to make sense of. Categorizing and analyzing that amount of data is a huge challenge for retail treasurers.

Multi-Channel Income and Expenses

Not only are there a huge volume of transactions, but they likely come from a wide range of sources. Depending on the business you might have online, bricks and mortar, third party resellers and more. There are also multiple payment channels for all of these, from credit cards, to Stripe or WePay integrations, down to straight cash.

Multi-Currency

And of course, for some businesses that’s not all going to be in USD either. Multinational companies have to contend with multiple currencies whose values all fluctuate at different rates against the USD, on a minute to minute basis. While at the same time, needing to be reconciled against US tax obligations.

Tax Jurisdictions

Speaking of which, is the massive amount of variability of sales tax, GST and VAT across different states and countries. All of this needs to be accounted for and reviewed to ensure all of your corporate obligations are met.

Slim Margins

On top of it all, retailers operate with some of the slimmest margins out there, meaning that you need to keep operations lean and efficient if you want to grow and thrive in a highly competitive sector where scale is the key to an (almost) unfair advantage.

Inconsistent Revenue

One of the various meanings for the term ‘Black Friday’ is that it’s the first day of the year that a retailer’s books are ‘in the black.’ The retail sector is punctuated by key events which drive a large portion of revenue, making forecasting an incredibly important component of treasury operations.

New Technology to Change the Face of Retail Treasury

The good news is that tech platforms such as Trovata can streamline the process for retail treasurers, and hugely improve the finance capabilities across all these areas. In a minute we’ll show you implementing this tech can give a retail treasurer some quick wins right away, but first let’s cover how it works.

For a deeper look at how retail treasury teams use tech to centralize store-level banking, carrier logistics, and cash deposits, check out our guide to simplifying store banking.

Open Banking APIs

Open banking is changing the way companies and their banks align. In the past, consolidation of financial information has relied on manual processes, taking data from multiple banking and payments portals and collating it all onto a spreadsheet. By the time the data was all collected and organized, it was already out of date.

Open banking APIs instead create a direct link between your multiple account providers, and a single source of truth, like Trovata. It means being able to see real time, 100% accurate data, at all times.

Cloud-Native Applications

‘The cloud’ is a term that has been so overused that it’s started to not really mean much. But broken down to its fundamentals, cloud-native technology provides a huge boost to productivity for finance teams operating in multiple regions and time zones.

Manual, spreadsheet based finance operations always create headaches, with multiple versions of your models, saved in shared folders all over the place, and with ridiculous naming conventions like “Forecast model Q1 V2.11 FINAL JP signed off.”

By using a cloud-based platform like Trovata, everyone is instead working on the same data. There’s no confusion and no miscommunication about which is the ‘right’ file to be working on. That saves time, improves productivity, and ultimately, saves money.

AI Integration

Now, AI has arrived on the scene, and it allows finance teams to take all of the data management functionality, and overly sophisticated analysis capabilities which even your non-technical team members can use.

Trovata AI is a great example of this, with users able to ‘interrogate’ their data to understand what’s going on behind the numbers. Need to know why office expenses were so much higher last quarter? Just ask Trovata AI, and it can dig into the numbers and look for anomalies or outliers.

Or what if you want to know how a 15% increase in advertising spend might impact your revenue figures for Q4? Ask Trovata AI, and it can build a scenario model that gives you that insight.

How Krispy Kreme Used Trovata to Cut Complexity and Improve Efficiency

All of these challenges have been epitomized by Krispy Kreme. The retailer of those delicious donuts has undergone a major expansion over the past five years, and while this has been a positive step for the company, it didn’t come without challenges.

With significant international expansion has come some serious revenue growth, making the treasurer’s role more crucial than ever. Not only do they need to ensure accuracy and organization across a rapidly increasing number of channels and transactions, but they also needed the ability to analyze how the expansion was working.

Were there areas that were proving more successful than others? Should they slow down the rollout in Country A and double the pace in Country B? How are the different rates of tax on their products impacting demand?

Under their traditional treasury management system, this data was disparate and needed to be constantly updated manually. That fact alone meant it was never 100% accurate, given the pace at which cash changes hands when selling an item that can cost less than $2.

Because Krispy Kreme knows volume. In 2022, they sold 1.63 billion donuts in 30 different countries. That’s a whole lot of lines to fit into a spreadsheet.

The old way of treasury management and cash flow analysis just simply wasn’t working, so they made the decision to implement Trovata into their business. The positive impact was fast and profound.

Here are 4 quick wins Krispy Kreme was able to notch by partnering with Trovata for their treasury management:

1. 100% Cash Visibility in Real Time

Through the use of open banking APIs, Krispy Kreme treasurer James Krikorian was able to gain 100% visibility over the company cash position, in real time. There is no longer a need for James to wonder how up to date the cash figures are, or look at multiple sources to tally up one combined figure. Not only that, but because the data is replicated directly from the bank accounts, there are no concerns about its accuracy.

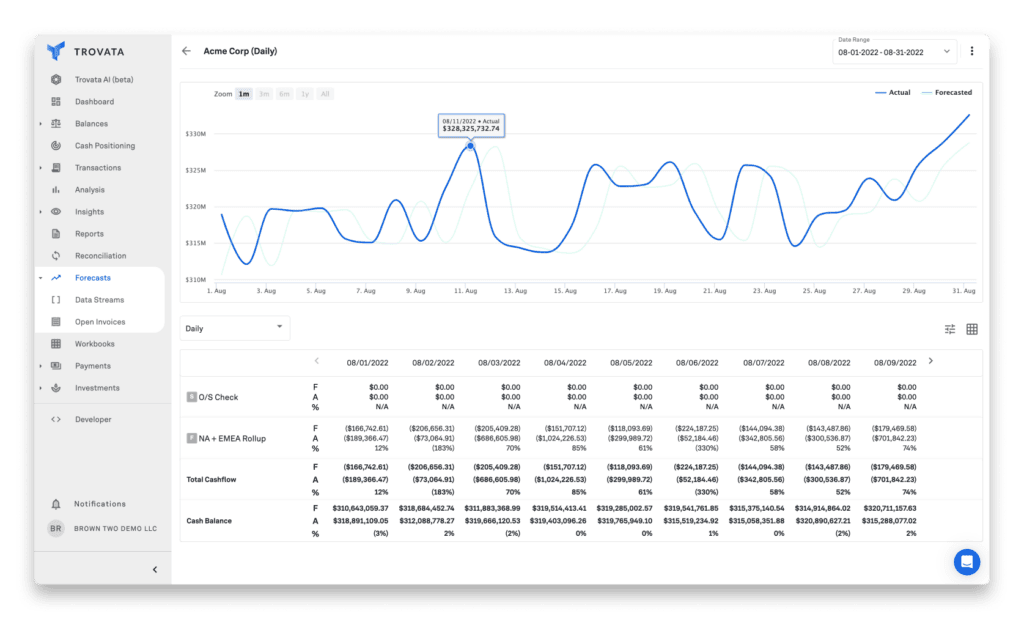

Trovata offers a single dashboard view of the entire company cash position, allowing treasurers to base their strategic decisions on data they know is current and accurate.

2. Data Consolidation and Consistency

Every organization has slightly different data protocols. They report on different metrics, or use slightly different calculation methods for the same metrics, or simply export data in different formats. That can make combining and comparing the data sources difficult, and again can require a heap of time-consuming manual work.

But with Trovata’s multi-bank data lake, all of this information is transformed into a common language, giving treasurers like James almost unlimited flexibility in the way they segment and analyze the data.

For example, it allows for the use of the tagging feature, which gives finance teams the ability to identify and categorize transactions based on specific criteria. This can help them to see trends and changes quickly, and have them automatically categorized into easy to understand segments. That’s pretty valuable when you’re selling 1.63 billion products a year.

3. Sophisticated Cash Forecasting

Having all of this data consolidated and organized in a consistent way, means that the ability to conduct forecasting and financial modeling is substantially improved. Treasurers can create far more accurate baseline scenarios, as well as detailed scenario planning based on changing assumptions or data.

This is particularly valuable for companies going through a significant growth phase, such as Krispy Kreme. The use of sophisticated scenario planning tools can help finance teams analyze which areas of the growth plan are working the best, and which are not. This can mean more efficient use of resources, by allocating more funds to the areas which are providing the best return on investment.

4. Natural Language Search

Finding and managing transactions for a company like Krispy Kreme is the definition of trying to find a needle in a haystack. The sheer volume of financial transactions, and the massive number of avenues from which these originate, means that narrowing things down or finding specific pieces of data can be nigh on impossible using traditional methods.

That’s why Trovato’s natural language search capability provides a massive quick win for finance teams. It allows users to search through the data using natural language prompts, rather than formulas or manual line by line review.

Need to double check your GBP/USD forex exposure for a specific period of time? Simply ask a question like “Find me all transactions made in British Pounds from 3rd October 2022 to 7th October 2022.”

It really is that simple, and provides a major boost to your finance capabilities from day 1.

Simplify Retail Treasury with Trovata

Quick wins are great, but the real power of using Trovata comes when these are stacked on top of each other over months and years. Improving data accuracy, speed and categorization means better strategic decision making, and those better informed decisions add up to real enterprise value over time.

For companies like Krispy Kreme, you can see how fast those benefits are realized, and why, in their words,

If you’d like to see how Trovata can improve your cash visibility, banking data aggregation, financial forecasting, scenario planning and more, book a demo today.