History has a strange way of repeating itself; One minute, seas are calm. Then without any warning, financial turbulence rattles businesses to the core. We’ve all witnessed the effects of a pandemic, leaving no business untouched and scrambling for a solution to their liquidity problems. Many businesses suddenly scrambled to right their operations by attempting to change their strategy midstream in order to navigate this uncertain time.

Treasuries that strengthened their operations before the pandemic by digitally transforming their operations were able to analyze, report on, and forecast cash faster and more accurately than their competitors. These organizations were able to identify potential opportunities and threats quicker, and utilize them to grow during the pandemic or sustain a larger financial hit due to lowering their cost of capital. By digitally transforming your treasury with an automated cash management platform, you can better identify and respond to major market shifts with real-time cash visibility.

How Legacy Technology Muddies Your View Amidst a Financial Crisis

Many treasury capabilities are limited to this day due to the overreliance on legacy technology within the financial space. While treasury management systems promise to automate the consolidation and normalization of bank data, manual intervention is often required due to low straight through processing rates. Days, and sometimes weeks, are often spent getting hold of bank data and consolidating it into a manual report. A manual report that only provides insights into your cash position at a specific time.

The pandemic demanded many businesses, especially those in brick and mortar locations, to overhaul their operations in a matter of weeks. The fact of the matter is that organizations who do not have a real-time view of their cash flow and position may not be able to adapt their cash management strategy quick enough to respond to drastic, unexpected changes in their cash flow.

Fortunately, incredible technological advances have occurred in the last few years that have empowered treasurers to achieve real-time cash visibility by establishing a single source of truth with an automated cash management platform. Trovata, our cash management platform, has empowered many treasuries to perform rapid, strategic decision making through a comprehensive suite of automated cash reporting, analysis and forecasting capabilities.

Gain Real-Time Cash Visibility with Automated Cash Management

Trovata, our automated cash management platform, is designed to empower you with better access to banking and cash data that is resilient, scalable, and future proof. This future proofing is only possible by establishing a big-data pipeline between your automated cash management platform and your many bank partners.

Automate the Consolidation and Normalization of Your Bank Data

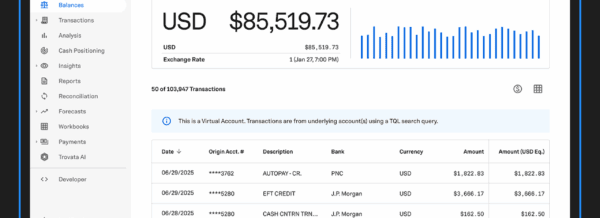

Direct-To-Bank APIs have truly made it possible to achieve real-time cash visibility. Trovata’s Direct-To-Bank APIs are future proof streams of data that establishes a big, financial data pipeline between your cash management platform and your many bank partners. These next level bank connections provide up-to-the-hour transactions and cash balance details, empowering you with real-time cash insights necessary for running your business in real-time.

Find the Data You Need, Exactly When You Need It

Our automated cash management platform, Trovata, doesn’t just consolidate data, it transforms it into meaningful, real-time insights. Powered by artificial intelligence and machine learning, AutoTag™ categorizes and segments transactions automatically, discovering deep patterns the human eye could never detect. With a simple keyword search, you can discover and reference historical data from key vendors, institutions, and more in milliseconds.

Have a Real-Time Pulse on Your Organization’s Financial Health

Visibility doesn’t just mean a line of sight – it means having access anytime, anywhere. Trovata truly eliminates your cash position and cash flow by providing fully-customizable and automated cash reporting and forecasting capabilities. From any tag, date, and filter, you have the ability to generate comprehensive, real-time reports and forecasts, and customize them with growth rates and variables of your choosing. Once generated, you can access these automated reports and forecasts via our mobile app, empowering you to have a pulse on your organization’s financial performance and to keep financial stakeholders in the know while on-the-go.

How Automated Cash Management Helps You Capture Growth Opportunities in Moments of Recovery

Automated Cash Management Encourages Exploration

Having your bank data automatically consolidated and normalized into a singular cash management platform in real-time frees your team up to perform analysis activities that propel your business forward. Generating cash reports and forecasts on specific vendors or institutions only take a few clicks, and any data point within these reports can be drilled down into, empowering you with a level of control no legacy TMS could even imagine achieving.

And with Trovata’s GridMode™, the normalized data from these reports can be exported to your spreadsheet of choice, further strengthening your analytical capabilities. Discovering your accounts’ cash flow and positions has never been easier, empowering you to refine your cash management processes and take advantage of growth opportunities hidden within your transaction data.

Empowers You to Forecast the Effects of Potential Business Decisions

Trovata doesn’t just amplify your ability to find insights within your current bank data, it empowers you to quickly analyze “what-if” scenarios across your entire business. Advanced Scenario Planning capabilities gives you the flexibility to apply growth rates and variables to your automated forecasts, providing you the ability to easily and accurately forecast around changing scenarios, business decisions, and potential investments.

Scenario planning transforms these unforeseen circumstances into cash management plans that can be implemented quickly as these situations arise.With this tool set, you are equipped to see how any growth opportunity, investments, or potential threats could affect your cash position.

Break Free From Legacy TMS Limitations

The truth is that companies that can create reports and forecast faster and more accurately than competitors can better take advantage of growth opportunities and cope better with downturns than their competition. If your legacy TMS is holding you back in gaining the real-time cash insights you need to make better business decisions, it’s time to consider breaking free from your legacy TMS’s limitations.

Download our guide, “The Cash Imperative,” to discover how modern technology can empower your treasury operations to reach its full potential by automating the consolidation and normalization of your bank data, cash reporting, and cash forecasting.