In today’s rapidly changing financial landscape, the ability to manage liquidity in real-time has become a critical imperative for CFOs and treasurers.

The shift towards digitalization and the increased pace of global transactions demand a more agile approach to liquidity management. In fact, a recent survey on CFOs and F&A professionals found that 62% of respondents stated that financial data in real-time is a “must-have” for their company’s resilience.

Real-time liquidity management not only ensures financial stability but also provides a strategic advantage in decision-making. This article explores the transformative power of real-time liquidity solutions, like those offered by Trovata, highlighting their role in navigating the complexities of modern finance.

Discover how embracing these innovations can safeguard and optimize your organization’s financial health.

Recommended: Check out our recent episode of Fintech Corner as our very own Joseph Drambarean and Brett Turner interview John Bolden, the Treasury Director at City Storage Systems, to discuss how APIs are revolutionizing treasury operations and how this cutting-edge technology is creating a wave of new possibilities in finance.

The Evolution of Liquidity Management

The journey from traditional liquidity management to the forefront of real-time liquidity management reflects a dynamic shift in the financial sector, fueled by technological advancements, regulatory changes, and evolving business needs.

Historically, treasurers relied on end-of-day reports to assess cash positions, a process that lagged behind the fast-paced nature of global commerce. This method, while effective in a slower economic environment, presented challenges in agility and risk management, leaving companies vulnerable to liquidity shortages and inefficient capital use.

The transition towards real-time liquidity management was catalyzed by several key factors. Financial institutions began to recognize the limitations of traditional methods, pushing for more innovative solutions to meet the demands of businesses operating in an increasingly interconnected global market.

Regulatory changes, such as those introduced by Basel III, emphasized the importance of liquidity coverage ratios and efficient liquidity risk management, further encouraging the adoption of real-time practices.

Technological advancements have been at the heart of this evolution. The development and integration of Application Programming Interfaces (APIs) into financial systems have enabled seamless, instant access to financial data across different platforms and institutions. This connectivity allows treasurers to view their liquidity positions in real-time, making informed decisions to optimize cash flow and working capital.

Fintech innovations have also played a pivotal role, offering tools and platforms that leverage big data, machine learning, and blockchain technology to provide deeper insights into liquidity management. These technologies have not only streamlined the process but have also introduced predictive analytics into liquidity forecasting, enhancing the accuracy and efficiency of financial planning.

As a result, the landscape of liquidity management has transformed significantly. Businesses are now equipped with the tools to manage their liquidity in real-time, ensuring optimal cash flow and working capital management. This evolution from traditional practices to real-time management represents a leap forward in financial strategy, enabling companies to navigate the complexities of the modern financial ecosystem with greater agility and foresight.

The Importance of Real-Time Liquidity Management

Real-time liquidity management is a sophisticated approach enabling businesses to monitor, analyze, and manage their cash positions and liquidity in real-time, rather than relying on periodic updates or end-of-day balances. This innovative management technique is crucial in today’s fast-paced business environment, where timely and accurate financial information can significantly influence strategic decision-making and operational efficiency.

The significance of real-time liquidity management has been magnified by several global trends and events:

Pandemic Impact

The COVID-19 pandemic underscored the importance of having instant access to liquidity information. As markets fluctuated dramatically and supply chains were disrupted, companies needed to make swift decisions on managing their cash to ensure sustainability.

Real-time liquidity management provided the agility to respond to these immediate financial pressures, enabling businesses to adjust their strategies quickly to preserve cash flow and maintain operations.

Globalization

With businesses increasingly operating on a global scale, managing liquidity across different currencies, time zones, and regulatory environments has become more complex.

Real-time liquidity management allows treasurers to navigate these challenges more effectively by providing a consolidated view of global cash positions, enabling optimized currency management, and reducing the risk of liquidity shortfalls in any part of the world.

Digitalization

The digital transformation of the financial sector has accelerated the shift towards real-time liquidity management. The rise of fintech, the development of APIs, and the adoption of instant payment systems have increased the speed at which transactions are conducted and settled.

This shift necessitates a real-time approach to liquidity management to leverage these technological advancements fully, ensuring that businesses can maximize their operational efficiency and capitalize on opportunities for growth.

The convergence of these factors—pandemic-driven volatility, the complexities of globalization, and rapid digitalization—has heightened the need for real-time liquidity management.

By enabling businesses to monitor their liquidity positions instantaneously, companies can better manage financial risks, optimize their cash reserves, and make informed decisions that support their strategic objectives and ensure their long-term resilience.

Challenges in Achieving Real-Time Liquidity

Achieving real-time liquidity management presents a myriad of challenges for businesses, demanding a nuanced understanding of both operational intricacies and the evolving regulatory landscape. Here are some of the primary hurdles encountered:

Intraday Liquidity Management

Managing liquidity on an intraday basis requires sophisticated systems and processes to track cash flows in real-time. Businesses often struggle with the lack of visibility into intraday transactions, which can lead to inefficiencies in utilizing available funds and potentially increase borrowing costs.

Forecasting Accuracy

Accurate cash flow forecasting is foundational to effective liquidity management. However, predicting future cash flows with precision is challenging due to the volatile nature of business operations, fluctuating market conditions, and unforeseen expenses.

This uncertainty complicates the task of ensuring sufficient liquidity to meet obligations without maintaining excessively high cash buffers.

Regulatory Compliance

Financial regulations vary significantly across jurisdictions and are subject to change. Staying compliant while managing liquidity across multiple regulatory environments adds complexity, especially for global businesses.

Regulations concerning capital adequacy, liquidity coverage ratios, and cross-border transactions require meticulous attention and can impact liquidity strategies.

Cross-Border Transactions

The growth in global business operations has led to an increase in cross-border transactions, which are accompanied by challenges such as currency exchange risk, differing time zones, and varied banking practices.

These factors can delay transaction settlements and obscure real-time liquidity positions, complicating global cash management.

End-to-End Visibility

Achieving a comprehensive view of liquidity necessitates integrating data from various sources, including bank accounts, payment systems, and financial institutions. Many businesses grapple with disparate systems and lack the connectivity needed for real-time visibility, hindering effective liquidity management.

These challenges underscore the need for advanced technological solutions and strategic partnerships with financial institutions and fintech providers. To overcome these obstacles, companies must invest in digital platforms that offer real-time data integration, advanced analytics for forecasting, and compliance tools that adapt to regulatory changes.

Additionally, embracing innovations like API-driven banking services, blockchain for cross-border transactions, and AI for predictive analytics can significantly enhance the accuracy and efficiency of real-time liquidity management.

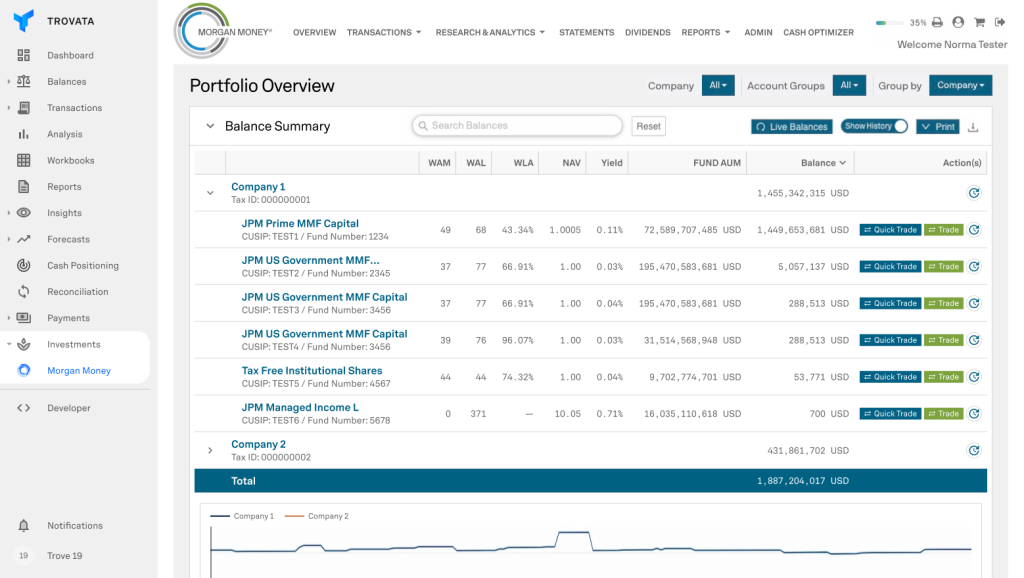

Trovata’s Real-Time Liquidity Management Solution

By harnessing the power of automation, robust integration with banking partners, and the strategic use of APIs, Trovata delivers instant financial insights, transforming how CFOs and treasurers manage and forecast liquidity.

Key Features:

Automation for Real-Time Data: Trovata automates the collection and consolidation of financial data across multiple bank accounts and platforms, eliminating the manual effort traditionally associated with these tasks. This ensures that financial leaders have access to up-to-date cash positions at any moment, enabling proactive liquidity management.

Integration with Banking Partners: Through direct API connections with a wide range of banks and financial institutions, Trovata facilitates seamless data flow, offering instant visibility into cash movements and account balances. This integration ensures that financial data is accurate, comprehensive, and timely.

Cash Flow Forecasting: Leveraging advanced algorithms and machine learning, Trovata offers sophisticated cash flow forecasting tools that provide insights into future cash positions. This predictive capability allows businesses to anticipate liquidity needs and plan accordingly, ensuring optimal liquidity at all times.

Cash Concentration Strategies: Trovata enables efficient cash concentration and pooling, allowing businesses to maximize the value of their idle cash. By automating the process of gathering funds from various accounts into a central account, companies can improve their interest income and reduce borrowing costs.

Optimization of Working Capital: The platform provides detailed insights into working capital components, helping businesses identify opportunities to free up cash trapped in operations. By optimizing receivables, payables, and inventory levels, companies can enhance their liquidity without the need for external financing.

Benefits of Implementing Real-Time Liquidity Management

The adoption of Trovata’s real-time liquidity management solution brings a multitude of benefits, positioning businesses to navigate the complexities of the modern financial landscape with confidence and strategic foresight.

Enhanced Risk Management

Proactive Risk Identification: Real-time visibility into cash flows and positions enables businesses to identify potential liquidity risks before they become critical, allowing for timely mitigation strategies.

Adequate Liquidity Buffers: With the ability to forecast cash flows accurately, companies can maintain optimal liquidity buffers, safeguarding against unforeseen market volatilities and ensuring financial stability.

Improved Decision-Making Capabilities

Strategic Financial Planning: Access to real-time financial data and predictive analytics empowers CFOs and treasurers to make informed decisions about investments, borrowing, and cash management strategies, aligning financial planning with business objectives.

Agility in Responding to Market Changes: The dynamic nature of Trovata’s solution allows businesses to quickly adjust their liquidity management strategies in response to changing market conditions, capitalizing on opportunities and mitigating risks.

Operational Efficiencies

Streamlined Financial Operations: Automation and integration reduce the time and resources required for financial data management, freeing up teams to focus on strategic activities rather than manual data aggregation and analysis.

Optimization of Financial Resources: By providing tools for effective cash concentration and working capital management, Trovata helps businesses optimize their financial resources, enhancing profitability and growth potential.

Take Action Towards Real-Time Liquidity Management With Trovata

Unlock the potential of optimal liquidity for your organization. CFOs and treasurers, take the first step towards real-time financial mastery by reaching out to Trovata. Explore our transformative solutions with a demo or consultation. Ensure your business’s liquidity is always at its peak.