When exchanging money for products and services, every business has to understand which payment systems and options are available to them. Each payment type, whether it is checks, ACH, Real-Time Payments (RTP), or wire transfers, all have their use cases, advantages, and disadvantages.

Having a solid understanding of which payment method is the best per a set of use cases can empower you to send payments on time while reducing transaction fees.

So, let’s take a look at when to send a check, wire, ACH or RTP and then we’ll go over a platform that helps your business to easily use all four of these payment methods.

Contents

Checks

While checks are not as commonly used by consumers, businesses still utilize them daily for payments. This is because checks are incredibly simple to send and receive, as each has a unique identifier within the form of a check number.

To review, a check itself is a written and signed document that directs a bank to pay a specific amount to the bearer, or receiver, which includes a routing number, check number, and checking account number. No vendor or bank coordination is needed, as all the information needed to deposit or cash a check is on there.

Sometimes, simplicity can result in further complications. From a time and process perspective, checks can be expensive. Each check issued by your business has to be inputted into your ERP, and then they have to be mailed out to your bearer.

Stuffing and licking envelopes, sticking stamps, addressing every check, etc… It becomes labor-intensive quickly. And with the bearer having to go to their bank to get their check cashed or deposited, it could take several weeks, if ever, to clear if the bearer never processes it.

Fraud also commonly occurs with a check. With all your major banking information on the check, if it gets into the wrong hands, it can be easy for the wrong person to process a check with their bank, especially with mobile check deposits. Fortunately, all major banks have fraud services that protect you from getting money stolen via check, but it also adds another potential time sink to your payment processes.

Advantages of Checks

- No vendor or bank coordination required

- Easy to reconcile due to each check having a unique identifier in the form of a check number

- Can float for several days

- Relatively cheap to initiate and process

Disadvantages of Checks

- From a time and process perspective, checks can be expensive

- Most commonly, fraud occurs via a check

- Checks can take a long time to clear–sometimes 3 days, some in 20, and some could never clear due to inaction

Wire Transfers

According to Wells Fargo, “A wire transfer is a method of transmitting money electronically between people or businesses in which no physical money is exchanged. The sender is the one who provides all the instructions for the transfer, which may include the recipient’s name, bank, account number, amount, and sometimes a pickup location.”

Fedwire or SWIFT acts as an intermediary, sending payments between the two parties. Typically utilized for small volume, large monetary payments, or international payments, wires are often a good option for sending money quickly.

While both a positive and a negative, settlement is immediate, meaning the receiver will obtain their cash quickly from you. The issue with this is that if you send a wire to the wrong recipient and account number, recovering those funds is very difficult, if not next to impossible. For this reason, wires are the most common type of fraud attempt by scammers.

Wires are immediate, reliable, and secure but also very expensive. A wire transfer can cost anywhere from $10 to $45 per transaction. For this reason, wire transfers are not realistic for many transactions, as with only 4 transactions, you could already be experiencing $40 to $180 worth of fees.

Advantages of Wire Transfers

- A great option if you need to transfer money urgently, move a large amount of it, or send it internationally

- Immediate, reliable, and secure

- Settlement is immediate

Disadvantages of Wire Transfers

- The most common type of fraud attempt by scammers

- Since settlement is immediate, if you send a wire to the wrong recipient and account number, it is nearly impossible to recover

- One wire can cost $10 to $25

ACH

Created and established by NACHA in the 1970s, the ACH network processes electronic financial transactions–such as direct deposit and direct payments–for consumers, businesses, and federal, state and local governments. ACH is typically utilized for any reoccurring payments, like businesses paying their workers, paying off a loan on a regular cadence, paying reoccurring operational expenses, etc.

ACH batches these recurring payments for processing. By batching, ACH retains a cheap, reliable, and secure payment experience. For many businesses, they create NACHA files via their ERPs to make it easier to share their recurring monthly payments with their banks, as they must complete a payment form and share with their banks of choice before being able to utilize ACH payments.

The biggest challenge to ACH payments is reconciliation. Since ACH batches payments of an organization together, banks will usually share just a batch number alongside the total of the batch payment on the general ledger. Due to this, treasurers, like yourself, will have to refer to a list of payments and figure out which particular payments were included in a particular batch. This can be incredibly time-consuming, as you can imagine. As well, settlement is not immediate, meaning it can take multiple weeks to clear, and they can be easily reversed, increasing risk.

Advantages of ACH Payments

- Cheap and reliable for recurring direct deposits and payments

- Secure system for paying workers, loans at a regular cadence, and other recurring operating expenses

Disadvantages of ACH Payments

- Difficult to reconcile since individual payments are not broken down when a batch payment reaches the general ledger

- Upfront vendor management required as name, address, and payment information is required to send an ACH payment

- Settlement is not immediate, meaning it can take multiple weeks to clear

Real-Time Payments (RTP)

Real-Time Payments is a new payment system that establishes real-time payment rails between businesses and banking institutions. Created by Clearing House Payments Company in 2017, whose members include some of the largest banking institutions in the world, RTP is empowering organizations and banks to make payments instantaneously with much more rich and detailed information than any other payment method before it.

According to J.P. Morgan, RTP doesn’t just send funds between the two parties, it also sends the settlement finality, instant confirmation, and integrated information flows necessary to invoice match between the payer and the bank. And with a first-ever bidirectional communication flow, compared to other commonly used payment systems, RTP empowers:

- Payment confirmation: Businesses are informed that funds have reached the payee’s bank account

- Request for payment: Vendors will be able to send a Request for Payment within an RTP in the future

While RTP is immediate and more secure than other payment methods, a lack of mass adoption can be an issue in the short term. According to John Adams, a journalist at the American Banker, the RTP network potentially covers 60% of all US consumer banks as of late October 2021.

Many banks still have to build the infrastructure to establish real-time payment rails before RTP can reach mass adoption.

Advantages of RTP

- Payments, settlement finality, instant confirmation, and integrated information flows are sent instantaneously

- Bi-directional communication flow between the payer and the banks enables RTP to send payment confirmations and request for payments

Disadvantages of RTP

- Not available at all banking institutions in the US

- Transaction fees are initially costly due to being a new technology

Send and Track Payments in One Platform

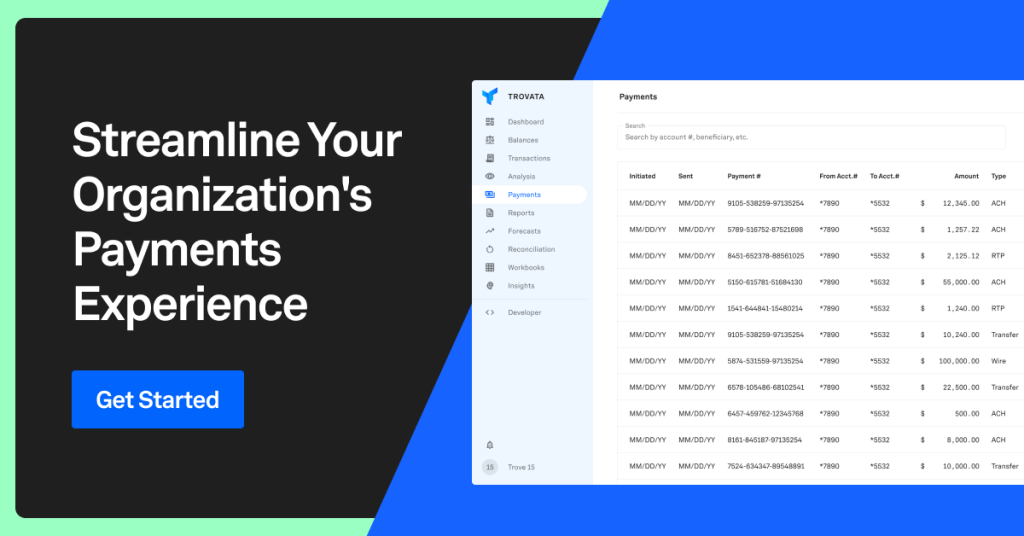

Trovata’s Payment App empowers treasurers and finance professionals to make transfers and initiate payments via ACH, wire, and RTP using the bank APIs directly, eliminating the need for a third-party intermediary and additional fees.

With payment workflows and templates, you can implement governance directly within your instance, ensuring all payments adhere to your company’s signature authority matrix, treasury policy, and internal controls. The payments dashboard amplifies a company’s ability to track payments from supported banks in one, secure platform.

See for yourself how you can send and track all your payments in one secure platform as a Trovata client with your J.P. Morgan, Wells Fargo, and Bank of America accounts. Get started today!