One of the hottest topics in the corporate world in recent years is the concept of turning cost centers into profit centers. As Amazon was growing its e-commerce business exponentially, their server costs were soaring. Rather than just continuing to stump up more and more cash each month, they launched Amazon Web Services (AWS) to manage their own servers, and sell cloud computing to others. Now, AWS is one of the fastest growing divisions of the company, and a key profit driver for the future. The same logic applies to supporting Enterprise Risk Management (ERM) with liquidity management strategy.

When ERM is done right, it can have a similar impact on a business. Managing risk shouldn’t be about stifling growth and limiting opportunities. With the right tools and strategy, it can unlock new and more efficient ways to work, which can actually help a business to grow and develop.

While of course, limiting potential downsides at the same time.

One of the key links here is the ability to manage cash. For every business, regardless of size or market sector, the way they manage cash defines how successful it can become.

Effective enterprise liquidity management (ELM) is absolutely essential for creating a sustainable long-term growth strategy, while also being a fundamental component of proper enterprise risk management. So, manage cash and liquidity in the right way, and you can reduce risk and maximize growth at the same time.

As with many things in life, that’s easier said than done. But luckily, it’s becoming more achievable all the time with the tech innovation flooding into the treasury management space.

From open banking APIs to cloud-based treasury management systems to the integration of AI and machine learning into scenario planning, modern CFOs and treasurers have far more assets at their disposal when it comes to managing liquidity and risk.

ERM and ELM: Two Sides of the Same Coin

The biggest risk any business can face is running out of cash. You can have the best product or service in the world and rabid demand, but if the cash flow cycle is disjointed or there’s a problem in your supply chain, things can go sour fast.

Conversely, the better control you have over your liquidity position and cash flow management, the more calculated risks you can afford to take in order to grow the company. If you have a very high level of confidence in your cash position, you can afford to allocate surplus to that new market or product line.

This is always true, but it’s even more relevant now given the uncertain economic environment we’re operating in.

According to Forrester’s 2022 State of Risk Management report, the “ability to stress-test risk scenarios” is a top priority right now. And let’s face it, we’ve had a lot of ‘risk scenarios’ to deal with in recent times.

This need in risk management highlights the increasing importance of tech solutions in the treasury team. Scenario planning used to be a labor intensive, manual process that involved a huge amount of employee time.

Companies like Crowdstrike were spending upwards of 40 hours a month simply gathering data on their current cash position. Add to that the need to transpose all the data into various spreadsheets and run (and troubleshoot!) manually created financial models in order to review different scenarios, and it becomes a herculean task.

Thankfully, through the use of cash management platforms, this has all changed. With open banking APIs allowing automatic and real time data consolidation, and sophisticated scenario planning tools built in, finance teams can save time, reduce risk and build better business strategy, all at the same time.

Using Scenario Planning to ‘Predict the Future’

Ok, so scenario planning obviously can’t actually predict the future, but it does allow you to plan for it in a far more effective way.

It’s through the use of scenario planning tools that enterprise risk management enterprise liquidity management come together. These tools allow finance teams and executives to consider the impact of a practically unlimited number of potential impacts to their business.

These can be negative events which concern risk managers, such as a drop in consumer demand or a hike in interest rates. For example, a business may have seen all the Twitter furore around Bud Light, and want to assess how negative press on a specific product could impact their bottom line.

They could run a scenario which takes into account a 50% drop in sales on that particular line, and see how this impacts their overall financial position. How much is the company’s overall profit reduced? Does it impact their logistics arrangements? What would be the appropriate response to the issues that crop up?

The scenarios don’t have to be quite so dramatic. Even smaller changes such as fluctuating exchange rates, higher than expected pay rises, or volatility in the price of oil impacting transport costs can all impact how a company performs. Scenario planning allows those in charge of enterprise risk management to consider them all.

So when we say companyies can see the future with scenario planning, we mean that they can gain an insight as to how different versions of the future might impact them, and plan for it. That’s the essence of enterprise risk management, and tools like Trovata make it possible to plan for multiple scenarios, without the need for hours of manual data manipulation.

Not only that, but through the use of AI and machine learning, the platform can automatically adjust forecasts as real time data comes in. Actual figures for details like revenue, payroll and accounts receivable timescales can be reconciled automatically, flowing through the forecasts you’ve created.

How to Manage Risk When You Can’t Plan Ahead

Scenario planning is hugely useful. But no matter how vivid your imagination or deep your experience, there are going to be events that happen which no one saw coming.

Who would have predicted the pandemic? Or the subsequent global lockdowns that happened as a result?

It’s for times like these when you don’t want to only rely on scenario analysis that you’ve already done in the past. Modern treasury teams need the capability to look at scenarios on the fly, with information that could be changing by the day or by the hour.

This type of crisis control is a fundamental component of enterprise risk management. Arguably, it’s the most important component, because there’s so little time to prepare for the impact to your company. To get this right, to have a robust risk management framework in place to deal with unexpected situations, these are some of the key pieces of the puzzle.

Real-Time Data

Real-time data is so important. If you’re making decisions in a crisis based on your cash position from three weeks ago, how can you really understand the impact of those decisions? The answer is, you can’t. At best, you’ll be making an educated guess.

Knowing that the information you’re looking at is accurate and up to date is a non-negotiable for enterprise risk management, and getting it right is the foundation for every other strategic planning decision in your business.

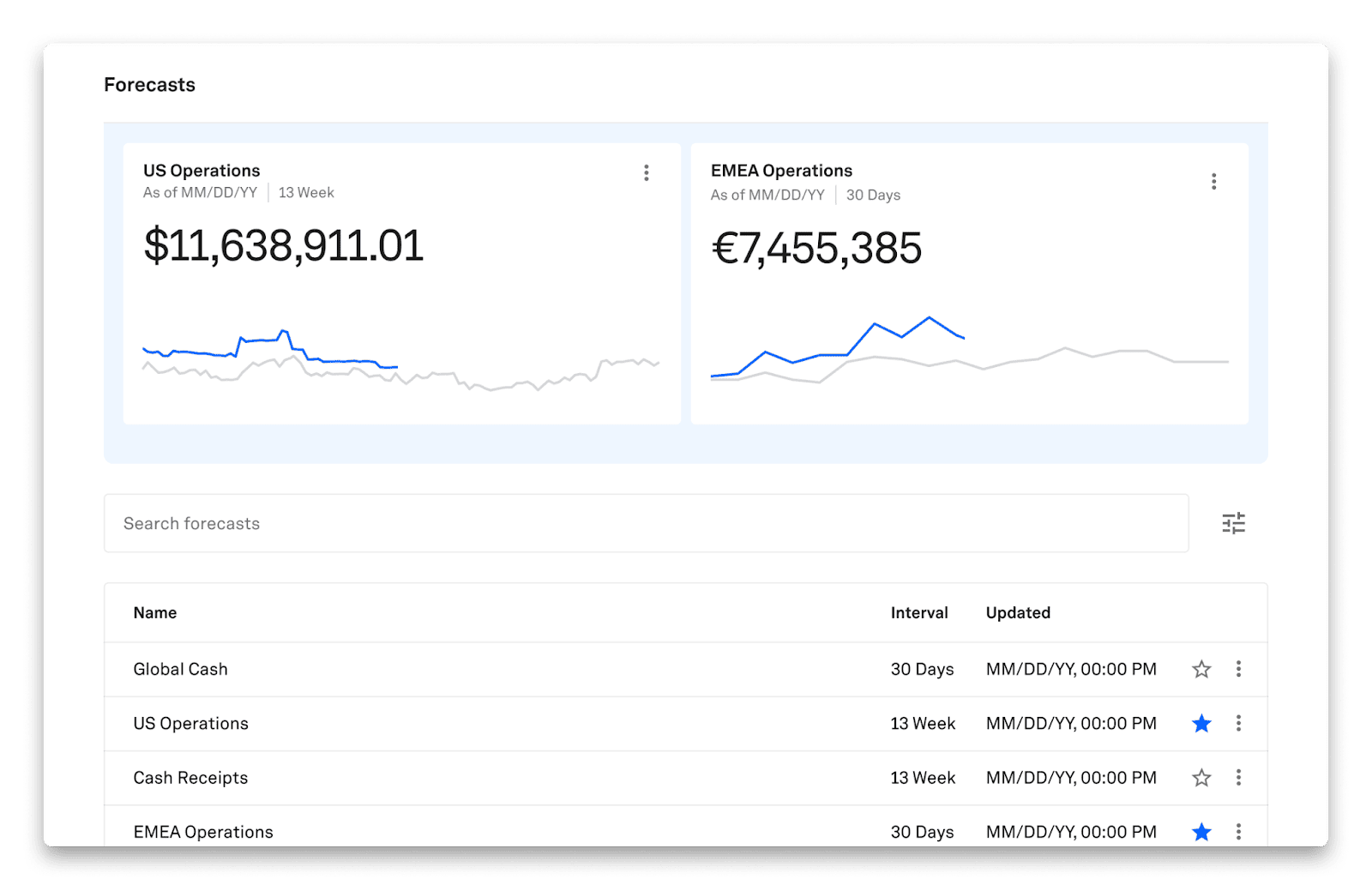

With Trovata, all of your company’s cash accounts are consolidated into a single dashboard, offering you a real time view of your entire corporate treasury position. At any time, you can see exactly how much total liquidity your company has, across every bank and currency.

Comprehensive, Automated Reporting

Having all the data is one thing, but it needs to be accessible. Different divisions of the business will need to see different pieces of data and across multiple timescales. In situations where time is of the essence, it needs to be possible to access the necessary information at the click of a button.

Now’s not the time to be building manual reports in Excel.

Trovata has all of this functionality built in. Our platform offers the ability to generate a wide range of reports, including scenario analysis, practically instantly. It means the right people, get the right information, right away.

Cloud-Based Collaboration

Especially for enterprise level companies, your employees and executives are likely to be geographically spread. That could be in offices across the country, or even across the world.

With that in mind, you need the ability to be able to collaborate quickly and effectively across multiple regions and time zones. Trovata creates a single ‘source of truth’ for your enterprise liquidity management, eliminating the issues that come with multiple spreadsheets and manual financial models saved in various joint folders (or, let’s face it, on an employees desktop).

Bank Level Security

To be truly agile, security is an absolute must. All the planning and agility in the world is for nothing if the system is vulnerable to cyberattacks or security breaches. Any new technology that you use to improve the efficiency and risk management capabilities of your treasury department, needs to have market leading security.

Through the use of open banking APIs, Trovata’s platform actually enhances corporate security. It allows the numbers being shown in your bank account to be reflected on the Trovata platform, without the need to login directly.

Because there’s no direct access to your account login information, the use of a single consolidated platform reduces the number of points of access to your actual banking portals. All information is transferred using 256 bit encryption and never leaves the United States.

Innovation Driven by Open Banking APIs

It’s this open banking technology that is fundamental to Trovata’s platform, and it’s a huge driving force in treasury cash management innovation. It’s an area that both risk managers and treasurers can’t afford to ignore, at the risk of falling behind the competition.

Just 5% of corporate treasurers surveyed at the end of 2022 were not currently using APIs and had no plans to implement them in their business in 2023. We don’t need to tell you that this means 95% of them are planning to, or already are.

And it’s clear why. Open banking APIs offer the ability to access a consolidated, real time view of their liquidity position across their entire company. It’s simple, but it’s a fundamental shift in the way that liquidity, and by extension, risk, can be managed.

Transform Liquidity Management Strategy with Trovata

In the current economic environment, the faster you can react, the more you reduce the risk to your business, and create the chance to take advantage of growth opportunities. That speed is being facilitated through the use of the technology we’ve covered such as open banking APIs, cloud-based collaboration, automated reconciliation, scenario planning and AI and machine learning integration.

And it’s all available on Trovata. Our modern treasury management system is making it easier and quicker for finance executives to get things done, and done right.

“Trovata has saved me multiple times when I needed a quick view of cash trends. I simply used my phone to login. It was so easy.”

Aurelia Sirbu – CEO of Orbus

Trovata can help you gain cash visibility, no matter how large your company. More than that, it can help you strategize, ensuring each piece of working capital is working for you and that each entity is doing its part to contribute to the whole. Ready to learn more? Book a demo today!