As any finance team knows, there’s been a fundamental change in the corporate landscape over the past few years. The relative stability of the post-2008 low interest rate environment has passed, and it now seems as if the goal posts are moving on practically a week to week basis. This major swing in interest rates, from basically zero to some of the highest we’ve seen in decades, has made the state of funding for growth stage companies particularly tough. But it’s not just that. The pandemic, upheaval in the labor market and the general economic turbulence has put pressure on every department. In our opinion, none more so than the finance team. That’s why it is essential to digitally transform treasury operations.

Where it used to be that treasurers could plan ahead with a reasonable level of certainty on the state of the economy and the fiscal landscape, that has changed. Now, finance teams need to be prepared to adapt quickly and efficiently, while still providing the company with sufficient resources for growth.

Put simply, budgets and forecasts can change quicker than ever, and modern treasurers need the capability to be able to analyze, report and model data in a fast and accurate way.

As a recent McKinsey study shows, the role of the CFO continues to grow. With bigger teams and a bigger voice at executive level, that also means higher expectations. Modern CEO’s don’t just look to the CFO for last quarter’s numbers, they now expect them to be an integral part of the forward looking strategy.

For that level of agility and efficiency, technology is a must. Not only will investing in the right tech allow you to make faster, more informed decisions, it will allow the finance team to limit the time spent on work like manual data entry and reconciliation.

Anyone who’s had to do that kind of work before will appreciate that this will almost surely mean happier employees, but most importantly will also create more time to focus on high value analysis and strategy.

As with almost everything in modern times, that comes down to data.

Solid data is now table stakes

Data used to be an advantage that could allow tech-savvy companies to see trends and opportunities that their competitors couldn’t. As tech integration within industries mature, strong data capabilities have moved on from being a competitive advantage, to becoming a necessary requirement to keep pace with the pack.

That’s simply because without the right data, senior executives won’t have all the facts in front of them to make the right decisions.

This is why, before there can be any conversation about strategy and forecasting, corporate treasurers need to ensure that the information they have is accurate and as close to real time as possible.

It’s particularly important for enterprise level businesses, as the larger a company grows, the more data there is to collate and the more dispersed it will be. Even something as simple as having revenue in more than one currency can create major headaches for real time cash management.

With currencies changing every minute of the day, manual cash consolidation makes it literally impossible to get an accurate, real time view of a company’s liquidity position.

And this isn’t just a hypothetical issue. You probably already know that, but it’s a common problem for CFO’s and senior finance executives everywhere. According to a survey from Blackline, 98% of executives felt they could be more confident in their cash flow visibility, and 42% felt that this lack of confidence was impacting their decision making.

While we’re talking about corporate financial data here, it really is common sense for any decisions in our lives. How can anyone be expected to make the right decisions, without all the information in front of them?

That’s why it’s really no surprise that over three quarters of CFO’s are planning on increasing their capital expenditure on technology in 2023. If you’re not planning on doing the same, can you expect to stay competitive?

The problem with traditional cash management

Spreadsheets have long been the center of the finance teams world. Teams of analysts would login to the company’s multiple bank portals (often in multiple currencies), review accounts payable and receivable and consolidate all of this information into something semi-readable for senior executives to review and strategize on.

Lack of real time data

That takes a substantial amount of time. For cybersecurity leader CrowdStrike, manual reporting like this was taking them around 40 hours per month. That’s valuable employee time spent on what is essentially copy and paste work.

But not only that, by the time the data has all been collated and presented to senior executives, it’s almost certainly out of date. Maybe during the ‘slow times’ those inaccuracies might be reasonably inconsequential, but throw in some volatility and it can become very inaccurate, very quickly.

When high inflation hit last year and the Fed began to rapidly increase interest rates, the uncertainty this brought to the table made completing this process even more of a challenge. Not only might the data be out of date by the end of the month, the macroeconomic backdrop could have changed completely too.

Utilizing cash management technology for viewing, reporting and modeling an enterprise level company cash position removes these problems, as CrowdStrike found out.

“As the Fed began aggressively increasing the interest rates, we were able to view cash balances real-time, analyze weekly trends of the inflows and outflows, and by overlaying our interest income projections, we were able to make informed and data-backed decisions for managing cash and investments.”

– Priti Kartik, Crowdstrike’s Senior Director of Treasury

Risk of errors

And all of that is assuming that the data being manually collated is accurate. Any time there is any manual component to a task involving spreadsheets, the potential for mistakes and miscalculations goes through the roof.

According to the European Spreadsheets Risk Interest Group (yes, it’s real, and the fact that it even exists says it all), over 90% of all spreadsheets contain an error. In many cases it’s not just the cost of the individual error itself that is a risk to your business, but the flow on impact of how that error impacts your corporate strategy.

Challenges with collaboration

This is improving, but seamless collaboration between multiple people and departments is a challenge when using manual spreadsheets. Different versions and scenarios can get mixed up, changes can be made without another person with access knowing, and keeping a clear audit trail of which is the current working draft is far more difficult than it should be.

This in turn, leads to a greater risk of errors.

4 ways tech is driving digital transformation in corporate cash management

That’s all the bad news. The good news, is that there are now solutions to these problems. Cloud-based treasury management software allows CFOs and treasurers to gain access to real time data with 100% accuracy, through the use of open banking API’s.

If that was all it did, it would be a game changer. But through the use of AI, machine learning and sophisticated planning tools, finance teams can also use this real time data to instantly create multiple forecast scenarios, find trends and even make payments directly through a single platform.

Let’s take a step back and look at these capabilities one by one.

1. Real time data feeds through open banking APIs

Open banking is a data standard which allows platforms like Trovata to aggregate the information directly from your banks. There’s no longer any need to login to multiple banking portals.

Instead, cash management platforms can access a secure connection to your bank account and show you this data in real time, on a single dashboard. There is no manual component to the process, meaning there is no potential for errors. Whatever figure is reflected on your original bank account, is the number you see on your cash management dashboard.

This isn’t fringe, untested technology. Open banking use is exploding globally, with many customer focused platforms, such as Venmo and Klarna, utilizing its capabilities. 76% of banks worldwide expect open banking API use and customer adoption to increase by at least 50% over the next three to five years.

2. Utilize AI, machine learning and scenario planning for improved reporting and forecasts

Being able to view this data is one thing, but where modern treasury management solutions really add value is in their ability to quickly iterate on reporting and forecasting. In the past, creating scenarios or viewing the potential impact of a slowdown in sales or an increase in headcount would mean manually creating a model in a spreadsheet.

Now it’s possible to do all of this automatically. The ability to quickly view the impact of a huge range of potential changes to your business, means you can make much more informed decisions, much faster.

3. Make better payments

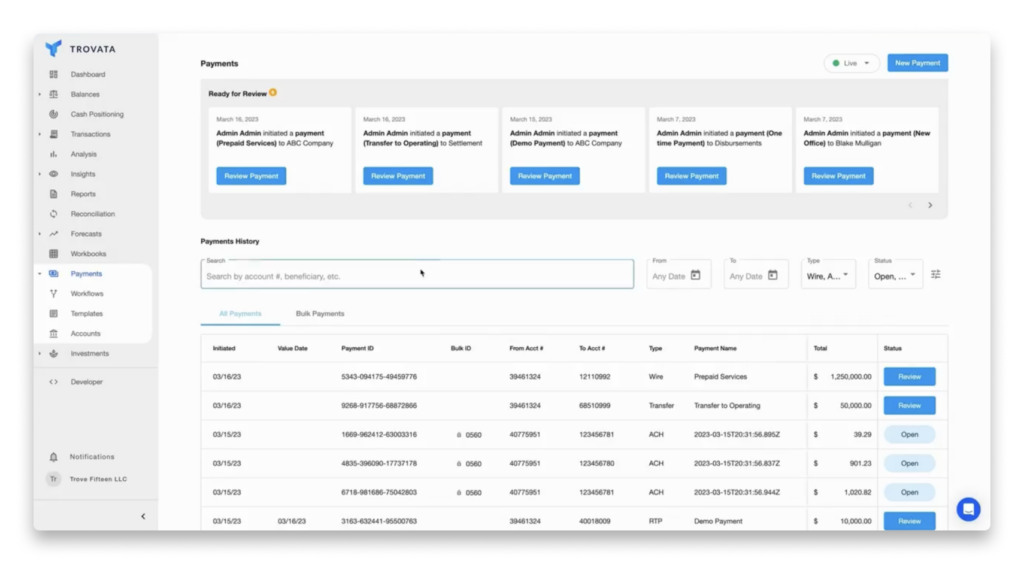

The benefit of open banking doesn’t stop at cash flow. It can also revolutionize the way you manage your corporate payments. Account-to-account payments functionality allows you to send and receive payments directly from the platform, cutting down the time it takes the team to process them, and saving on intermediary fees in the process.

Not only does this make managing payments easier, but it allows you to build processes to reconcile transactions and initiate refunds automatically, taking tasks of your teams plate and freeing them up to spend time on more high value work.

4. Collaborate with ease

One of the simplest, most overlooked challenges in finance teams is collaboration. Especially in the age of remote work, spreadsheets were simply not designed to be used by multiple people. We’ve all been in the situation where there are six different versions of the same model, with naming conventions that become increasingly ridiculous (FINAL V4.1 – D anyone?).

With cloud based cash management software, that issue goes away. Teams all work from the same source of truth, and changes made by your CFO in New York automatically update for your junior analyst in San Diego.

Digitally Transform Treasury Operations With Trovata

Open banking is simply a better way to manage cash at the enterprise level. It allows for real-time visibility of your liquidity across multiple banks and currencies, allows the team to collaborate on and view the same data and drastically improve reporting, forecast and payments.

Combined, this allows treasury departments to save dozens of hours per week, freeing them up to focus on analysis and decision making.

With Trovata you can gain unmatched visibility of cash daily across all accounts, empowering you to better understand liquidity to make the most out of excess cash. Aggregate, search, tag, analyze, forecast, and report; gain everything you need to make smarter, faster decisions. Elevate your enterprise treasury operations with Trovata’s superior tools.

To learn more about how you can leverage this technology to improve your reporting, cash visibility, forecasting and payments capabilities, download the Trovata Platform Data Sheet today.