Imagine a world where every one of your financial decisions is backed by a crystal-clear understanding of your business’s financial health. No more grappling with spreadsheets, manual reconciliations, or the nagging feeling that you might miss crucial insights.

Traditional bank reconciliation accounting tools have some frustrating downsides. Most glaringly, it leaves decision-makers without real-time data. Monthly or weekly reports can make financial decision-making feel like navigating a maze blindfolded. But there’s a solution.

In this article, we’ll discuss the power of automated bank reconciliation accounting. We’ll show you how it can save precious time and empower your team with up-to-date knowledge to make savvy financial decisions. Say goodbye to guesswork. The path to informed decision-making begins with automation.

The Importance of Accurate Bank Reconciliation

Bank reconciliation is more than just a financial chore; it’s a strategic tool that empowers your business with the information needed to make informed decisions. Here are five compelling reasons why bank reconciliation matters for your business:

- Data Accuracy: Bank reconciliation ensures that your financial records align accurately with your bank’s records. This accuracy is essential for confident decision-making. Inaccurate data can lead to misguided choices that may harm your financial health.

- Real-Time Insights: Automated bank reconciliation provides real-time visibility into your bank balances, cash flow, and financial transactions. This information allows you to spot potential issues early and take corrective action promptly.

- Cash Flow Management: Accurate bank reconciliation helps you optimize your cash flow. You can identify trends in your financial transactions, pinpoint areas where funds may be tied up, and make informed decisions to enhance liquidity and overall financial stability.

- Handling Bank Errors: Automated reconciliation systems can identify and flag common bank errors, such as discrepancies in transaction amounts or missing entries. This capability allows you to rectify errors promptly, preventing financial discrepancies from affecting your decision-making.

- NSF Checks and Bank Charges: Automated reconciliation detects NSF (Non-Sufficient Funds) checks and facilitates timely action to address these issues. By avoiding NSF checks, your business can maintain smoother cash flow and reduce disruptions. Additionally, reconciliation software helps track and account for bank charges, ensuring that your financial records are comprehensive and accurate.

Incorporating bank reconciliation into your financial practices equips you with the tools and insights needed to make strategic financial decisions with confidence.

What is a Bank Reconciliation Statement?

A bank reconciliation statement is a vital financial document that aligns your company’s records with your bank’s. It ensures accuracy and financial health.

This statement compares your bank statement, listing bank transactions, with your internal accounting records, documenting your business’s financial activity. Any disparities, like outstanding checks or data errors, are identified and resolved. The goal is to match your adjusted records with your bank’s ending balance.

If differences persist, further investigation is needed, such as contacting your bank or reviewing past transactions for errors.

Overview of the Bank Reconciliation Process

The bank reconciliation process is a financial practice that ensures your company’s records align with your bank’s records. It’s a critical step in verifying the accuracy of your financial transactions and maintaining your financial health. Here’s a step-by-step overview of the process:

- Gathering Financial Statements: Begin by collecting your bank statements. These statements detail all transactions, including deposits, withdrawals, checks, and bank fees, processed by your bank during a specific period. They will also reveal your bank statement balance.

- Comparing Records: Next, meticulously align the transactions recorded on your bank statement with your company’s internal accounting records. These internal records, often managed through accounting software or spreadsheets, should encompass every financial transaction your business executes.

- Identifying Discrepancies: It’s commonplace to unearth disparities between your bank statement and internal records. These variances may include outstanding checks, unrecorded deposits, bank fees, or even occasional errors in data entry.

- Reconciling Differences: To address these disparities, meticulously adjust your internal records to harmonize with your bank statement. For instance, if you identify an outstanding check that remains uncleared, subtract its value from your internal records.

- Ensuring Balance Agreement: The ultimate aim, after implementing these adjustments, is to align your revised internal records with the concluding balance stipulated in your bank statement. When this harmony is achieved, your bank account is considered reconciled.

- Investigating Discrepancies: In instances where variances persist, a deeper inquiry may be necessary to uncover their origins. This may entail contacting your bank for clarification or delving into past transactions to pinpoint potential errors.

The bank reconciliation process stands as a vital practice, preserving the financial integrity of your business by guaranteeing the synchronization of your records with those held by your bank.

Who Is Responsible for Bank Reconciliation Accounting?

Bank reconciliation accounting is a crucial financial practice that involves several key personnel within a company. Here are the primary roles involved:

- Accountants: Accountants are typically responsible for the day-to-day reconciliation process. They gather bank statements, compare records, identify discrepancies, and make necessary adjustments.

- Financial Controllers: Financial controllers oversee the entire reconciliation process. They ensure that the bank reconciliation is performed accurately and on time.

- CFOs (Chief Financial Officers): CFOs play a critical role in the final review of the reconciliation results. They use the reconciled data for strategic financial decision-making.

- External Auditors: In some cases, external auditors may review the bank reconciliation statements as part of their auditing process to ensure compliance and accuracy.

- Bank Representatives: Bank representatives may also collaborate with the company’s financial team to resolve discrepancies and clarify bank-related issues.

How Often Should You Perform Bank Reconciliation?

The frequency of performing bank reconciliation largely depends on your business’s transaction volume and financial needs. Here are some considerations:

- Monthly Reconciliation: For many businesses, especially small to medium-sized enterprises, bank reconciliation at the end of the month is a common practice. It strikes a balance between regular oversight and operational efficiency.

- Weekly Reconciliation: In some cases, businesses with a high volume of transactions or those that require close monitoring of their financial health may opt for weekly reconciliation. This more frequent approach helps identify and address bookkeeping discrepancies promptly.

- Daily Reconciliation: For larger enterprises or those with substantial cash flows, daily reconciliation can be essential. It offers real-time insights into financial status and is particularly crucial for industries with rapid changes in cash balance, like retail.

- Special Circumstances: During specific circumstances, such as audits, financial reviews, or when unusual economic activity is suspected, you may need to conduct ad-hoc reconciliations. These ensure immediate clarity and data accuracy.

Ultimately, the frequency of bank reconciliation should align with your business’s specific requirements. Regular reconciliation not only ensures the accuracy of financial data but also enhances your ability to make timely and well-informed decisions.

Manual vs. Automated Bank Reconciliation

Bank reconciliation, the pivotal practice in maintaining financial accuracy, can be approached in two distinct ways: manual and automated. Here, we shed light on the key differences between these two methods, unveiling the limitations of manual reconciliation and the manifold benefits of embracing automation.

Manual Reconciliation

In the manual realm, bank reconciliation involves painstakingly matching each transaction in your bank statement with its counterpart in your accounting records. It’s a meticulous, time-consuming process that relies heavily on human scrutiny. While it may suffice for small-scale operations, manual reconciliation becomes increasingly impractical and error-prone as transaction volumes grow. Manual reconciliation poses several limitations, most notably in scalability and efficiency. As your business expands, the sheer volume of transactions becomes overwhelming, increasing the likelihood of errors. Moreover, manual reconciliation offers limited insights into real-time financial data, making it challenging to make informed decisions promptly. Consider the following:

- 62% of C-Suite executives and financial professionals said real-time visibility into cash flow is a “must-have” for their businesses’. 92% said they could be more confident about their current level of visibility.

- 49% of finance professionals worry cash flow data is unreliable

- 59% of executives plan to invest in tech over the next 12 months.

Business leaders are prioritizing accurate, real-time financial data in order to build organizational resiliency, agility, and continuity. Cumbersome, manual processes are no longer enough to keep up with unpredictable nature of the modern market. Technology has taken center stage to meet these challenges head on.

Automated Reconciliation

In stark contrast, automated bank reconciliation harnesses the power of technology and specialized software to expedite the process. This approach not only significantly reduces the time required but also enhances accuracy. Automated systems effortlessly cross-reference countless transactions, flagging discrepancies and errors with precision.

Embracing automation offers a multitude of advantages. It not only streamlines the reconciliation process but also minimizes the potential for human errors. Furthermore, automated systems provide real-time financial insights, empowering you to make informed decisions promptly, which is particularly vital in today’s fast-paced financial landscape. By transitioning to automated bank reconciliation, you not only save valuable time but also fortify your financial management with enhanced accuracy and efficiency.

The Role of Accounting Software

Accounting software plays a pivotal role in automated bank reconciliation. It streamlines the entire process and significantly improves accuracy. The software is designed to handle vast volumes of financial data and cross-reference transactions with precision. Here’s how it works:

- Time Savings: Utilizing specialized accounting software, the reconciliation process becomes seamless. The software automatically matches transactions between your bank statement and your accounting records, including general ledger accounts.

- Efficiency Gains: With the power of automation, the software processes numerous transactions quickly and accurately, reducing the need for manual intervention and ensuring that bank errors and NSF checks are promptly identified and addressed.

- Streamlined Journal Entries: Automated reconciliation software simplifies the creation of journal entries, further improving the efficiency of the reconciliation process. It eliminates manual data entry errors, ensuring your financial records remain accurate.

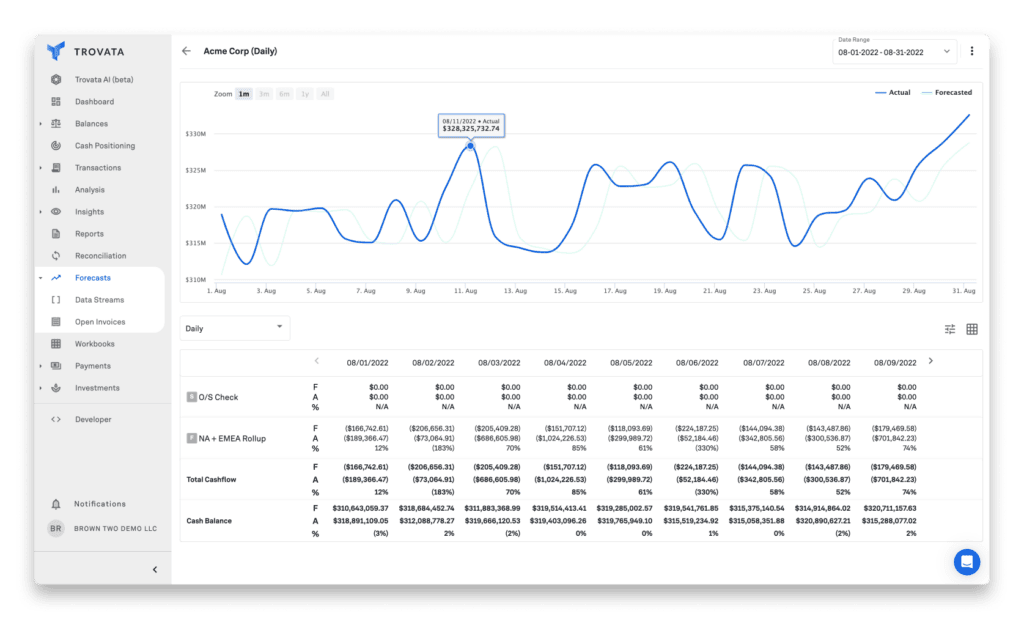

Strategic Forecasting and Planning

The advantages of automated reconciliation extend far beyond immediate reconciliation tasks. They empower businesses to engage in strategic forecasting and meticulous financial planning, all thanks to refined data and real-time insights.

Refined Data for Strategic Planning

Automated reconciliation ensures the accuracy and completeness of your financial data. This refined data serves as a solid foundation for strategic planning. With confidence in your financial records, you can embark on long-term financial strategies, such as expansion, investment, or diversification, knowing that your decisions are grounded in precision.

Real-Time Insights

Automation delivers real-time financial insights, enabling businesses to stay agile and responsive to changing market conditions. Predictive scenarios, simulations, and “what-if” analyses become more accurate and actionable, allowing you to anticipate potential financial challenges and plan accordingly.

Optimizing Cash Flow

With refined data at your fingertips, optimizing cash flow becomes a strategic endeavor. Automated reconciliation helps you identify trends, pinpoint areas where funds may be tied up, and make informed decisions to enhance liquidity and overall financial health.

Incorporating automated reconciliation into your financial practices not only streamlines day-to-day workflows but also empowers your organization to take a proactive stance in strategic forecasting and planning, ultimately driving sound financial decisions.

Reconciliation as a Catalyst for Digital Transformation

In today’s digital world, blending online banking with internal finances is more than a convenience—it’s a must. Tools like automated bank reconciliation help businesses smoothly manage their cash, keeping tabs on every transaction, from credit card spending to interest income. Trovata’s integration with the Sage Banking Service API shows how this shift works. It provides a blueprint for tasks like balancing checkbooks and tracking financial records, reducing risks like NSF checks, and giving a clearer view of bank fees and statements. This digital makeover streamlines operations and offers better control over business records.

Bank Reconciliation Examples With Trovata:

- A CEO employs Trovata to monitor daily cash flow, ensuring that the company has the liquidity required to fulfill its obligations.

- A small business owner leverages Trovata to pinpoint areas for cash flow improvement, be it through inventory optimization or extended payment terms negotiation with suppliers.

- A sales manager utilizes Trovata to forecast future cash flow needs, keeping the sales team aligned with its objectives.

- A marketing manager taps into Trovata to assess the return on investment (ROI) of marketing campaigns, optimizing the allocation of the marketing budget.

- A CEO notices a recent decline in the company’s cash flow. Utilizing Trovata, they identify specific areas where cash is slipping away—possibly excessive inventory expenditures or delayed customer payments. Armed with these insights, the CEO can proactively address these cash flow challenges, resulting in improved financial performance and more informed business decisions.

Automate Your Bank Reconciliation Processes with Trovata

In the ever-evolving finance landscape, the importance of bank reconciliation cannot be overstated. Traditionally seen as a procedural task, it now stands as a guiding light for companies, offering accurate, real-time insights that empower strategic financial decision-making. Regardless of your business’s size or industry, bank reconciliation ensures that you navigate the complex waters of finance with clarity and precision.

By embracing technology and automated systems, you not only streamline the bank reconciliation process but also fortify your financial records with reliability and accuracy. This newfound financial clarity arms you with the tools needed to make informed decisions that can shape the future of your business.

Don’t let financial ambiguity hold you back. Take the reins of your financial journey, armed with the power of bank reconciliation, and steer your business toward a future of informed strategic financial decisions.