Hotel treasury management is a complex maze of juggling multiple properties and keeping a handle on cash flow. Each location hosts its own trove of financial data, creating a complex web of varying currencies, bank portals, and spreadsheets. This makes it difficult to gain a clear view of cash position, daily balances, and overall financial health – hindering your ability to make strategic decisions in the process. Fortunately, modern technology offers a powerful solution to help simplify and centralize cash data across your organization’s entities.

This transformation goes beyond mere convenience. It unlocks a new level of financial control, empowers strategic decision-making, and can even lead to significant cost savings. Let’s delve deeper into how leveraging APIs, AI, and machine learning can revolutionize your role as a hotel treasurer.

Challenges with Hotel Treasury Management

As we touched on, each property generates its own revenue stream, incurs expenses, and maintains its bank accounts. The treasurer’s responsibility becomes a constant challenge of gathering individual financial data from each location.

Traditional methods involve manual data entry from bank statements, emails, and internal reports. This not only eats up valuable time but also introduces the risk of human error. Discrepancies can hide for months, impacting cash flow forecasts and hindering strategic planning.

Even if you have automated systems in place like PowerBI or similar solutions, they aren’t equipped to provide you with real-time visibility into daily cash balances. This limits your ability to make strategic decisions.

The API Revolution: Seamless Bank Connectivity

This is where APIs add value as a transformative solution to help you gain real-time visibility into cash flow. They act as bridges between modern treasury management software and your banks. By establishing secure connections through APIs, you can automate the retrieval of real-time bank data. That’s why it’s no surprise that a recent survey found that 42% of treasury professionals are actively engaged in implementing APIs.

Here’s how it works:

- Streamlined Data Flow: APIs allow for a continuous, automated flow of data directly into a centralized system. This eliminates the need for manual data entry and reduces the risk of errors.

- Real-Time Visibility: With API connectivity, you gain access to real-time information on your overall cash position across all locations. No more waiting for individual reports or manually consolidating spreadsheets. You can see the complete picture at any given moment.

- Enhanced Security: APIs utilize robust security protocols to ensure the safe transfer of financial data. Encryption and access control measures guarantee that only authorized personnel can view sensitive information.

Recommended: Check out our recent episode of Fintech Corner where our very own Joseph Drambarean and Brett Turner interview John Bolden, the Treasury Director at City Storage Systems, to discuss how APIs are revolutionizing treasury operations and how this cutting-edge technology is creating a wave of new possibilities in finance.

Centralized Data: The Foundation for Strategic Control

With real-time data flowing through APIs, you can establish a central hub for all your multi-entity financial information. This centralized data system becomes the foundation for a more strategic approach to liquidity management.

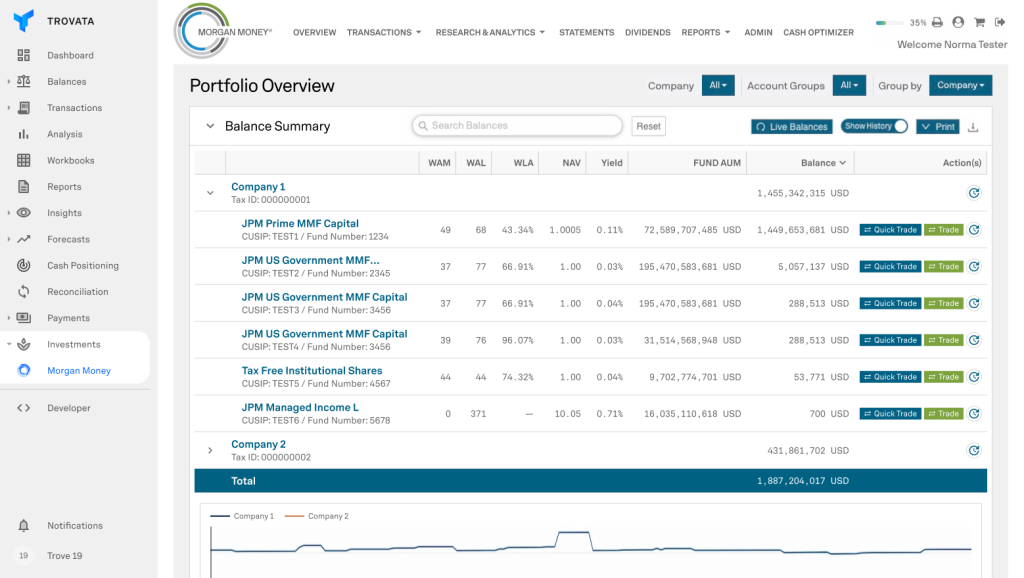

Consolidated Reporting: With an API-first approach to reporting, you can gain a single dashboard displaying the real-time financial health of your organization. You can also get granular with reports of every hotel in your chain. This centralized platform allows you to generate consolidated cash flow reports that paint a clear picture of your overall financial standing.

Improved Forecasting: With centralized, real-time reports, you can create accurate, consolidated cash flow forecasts for your entire organization. This empowers you to make informed decisions about resource allocation, investment opportunities, and debt financing.

Enhanced Control and Compliance: A centralized system allows you to monitor bank balances, track transactions across all locations, and identify any discrepancies or potential issues. This empowers you to maintain tighter control over your finances and ensure every branch adheres to financial protocols and compliance regulations.

AI and Machine Learning: Building a Smarter Cash Flow Foundation

AI and machine learning enable you to go beyond real-time data visibility and unlock deeper insights. Here’s how:

Building a Strong Foundation: Leveraging Historical Data

AI and machine learning algorithms don’t operate in a vacuum. They learn from vast amounts of historical financial data. Modern, API-first treasury management software leverages AI and machine learning to analyze your historical data. This then becomes the baseline for your cash flow forecasts. The system analyzes past trends, seasonal variations, and external factors to build a more accurate picture of your future financial landscape.

Automating the Mundane: Data Normalization and Tagging

Manual data entry and normalization can be time-consuming and error-prone. A modern treasury management platform offers tagging capabilities that allows you to set rules and categories for your bank data. As APIs flow data to the system, AI automatically cleans and standardizes incoming data from your various banks. This ensures consistency and reduces the risk of errors that can throw off your reports and forecasts.

In essence, AI and machine learning in treasury management software work as your intelligent partner. They learn from your past, automate tedious tasks based on your guidance, and empower you to make smarter financial decisions for the future.

The Benefits Beyond Efficiency: Cost Savings and Strategic Gains

The impact of modern technology goes beyond streamlining processes and improving efficiency. Hotel treasurers who leverage APIs, AI, and Machine Learning can unlock significant cost savings and strategic advantages.

Reduced Bank Fees: Many banks charge fees for generating reports through their online portals. These fees can quickly add up, especially for treasury operations for hotels. An API-first treasury management platform centralizes reporting, eliminating the need for your team to log into individual bank portals. This streamlines the reporting process and saves you money on per-report fees.

Improved Investment Returns: With real-time data and predictive analytics, you can identify opportunities to optimize your cash utilization. Having clear insights into your cash flow allows you to invest idle funds strategically, potentially generating higher returns and improving your overall financial performance.

Enhanced Decision-Making: Access to real-time, consolidated data empowers you to make data-driven decisions. You can identify underperforming locations, optimize resource allocation across properties, and seize time-sensitive investment opportunities – all with a clear understanding of your financial standing.

Building a Culture of Data-Driven Decision Making

Technology is just one piece of the puzzle. To truly unlock the potential of modern financial tools, it’s crucial to foster a culture of data-driven decision-making within your organization.

- Executive Buy-In: Gaining the support of your executive team is essential for successful implementation. Educate them on the benefits of centralized data management, automated processes, and AI-powered insights.

- User Training: Equipping your team with the skills to navigate new financial technology is crucial. Seek tech vendors that offer a comprehensive onboarding process.

- Data Governance: Establish clear data governance policies to ensure the accuracy, consistency, and security of your financial data. This includes defining data ownership, access control measures, and data quality control procedures.

Trovata: Simplify Multi-Entity Treasury Management for Hotels

In today’s competitive hotel industry, maintaining a clear and real-time grasp on your cash flow is essential. Many hotels struggle with a lack of real-time visibility into cash flow, manual data entry, time-consuming reconciliations, and a lack of actionable insights from their financial data. Trovata is a dedicated cash flow management system designed to revolutionize your financial operations.

Trovata offers a comprehensive suite of features specifically designed for treasurers. Gain instant visibility into your daily inflows and outflows. Harness the power of Trovata’s data analytics to identify seasonal fluctuations, analyze spending patterns, and uncover hidden trends within your financial data. This empowers you to make data-driven decisions that optimize hotel performance and maximize profitability.